Executive Summary

Has A much needed and healthy risk asset correction may turn into something more malign given US centric, self inflicted wounds. Regime changes are in train across the board: equality, climate, policy, politics & thus markets.

Fed Chair Powell begging Congress for more stimulus while the US President questions the peaceful transition of power is, shall we say, not a good look. Yet all is not lost. While we wave goodbye to the Fed put we say hello to the Mnuchin plunge protection team - down 10% and the call goes out.

US equity risk reward seems poor going into a contested election with Tech exposed to vaccine “kryptonite”. Rotation interrupted, not reversed; post election stimulus likely. We remain with a Cyclical/Value tilt and non US equity bias. Long duration Sov debt at risk to a mini taper tantrum & possible bear market. We are dollar sellers on the bounce and continue to favor Commodities including industrial metals/miners & clean energy.

HEALTH

Good news, bad news. The good: rapid testing is here and vaccine trials remain on track for a vaccine in coming months. Bad news: US has abdicated on the federal level and case levels are rising sharply in parts of Europe. Better Covid control through science is coming fast & will upend portfolio structures.

ECONOMICS

Good news & bad. The good: a global synchronized upturn is underway, supported by record setting global liquidity. The bad: more, politically difficult, fiscal support is needed, especially in the US. Regime change is never easy.

POLITICS

Political risk is US centric - any Qs, ask President Trump. BIden’s lead has been constant for much of the past year. Better polling quality & no 3rd party candidate suggests it's his race to lose. Surprise would be a smashing, Election night, Biden win - watch Fla.

POLICY

We have entered both Peak Central Bank territory & the more politicized world of Fiscal Policy. China’s DCS, Europe’s furlough program & US pandemic support all the same policy - support/grow consumption. China, Germany, US drive the Tri Polar World of Asia, Europe & the Americas.

MARKETS

Tech selloff clears the froth away. Rotation trade (both sectoral/style & geographic) remains the focus. Imminent vaccine, synchronized global recovery & abundant liquidity support risk assets on a 12 month basis. New inflation regime to impact pension, risk - parity, 60-40 funds. Regional FX blocs centered around USD, Euro, RMB coming into focus.

Much, much more inside.

Read MoreIn 7 minutes, Jay covers the Rotation Trade - both sectoral and geographic, US election risk, Asian equity market outlook and an ESG/green energy ETF opportunity.

Read MoreTight 4 min clip where Jay goes cross asset with Jon Ferro: equity, FX, bonds, explains why a vaccine is tech kryptonite and highlights the Rotation Trade taking place underneath the Tech selloff - the real key mkt action.

Read MoreWhat can investors do when the easy money has already been made? Managing editor, Ed Harrison, explores this question and more with Jay Pelosky, chief investment officer and co-founder of TPW Investment Management. Pelosky shares with Harrison his base case for China, Europe, and the U.S. as well as emerging markets, and he describes as what he sees as weakness in the long-end of the U.S. Treasury yield curve. Pelosky and Harrison then discuss how a successful vaccine would affect specific sectors of the market, such as tech and industrials. Finally, after sharing his thoughts on how the 2020 election would impact markets, Pelosky analyzes the potential new geopolitical coalitions that could form should deglobalization continue.

Read MoreXXXXXXXXXXXXX

Read MoreJay Pelosky CIO sat with Fabian A. Onetti Founder of Winston Capital Advisors who brings 30 years experience in banking with 24 at Morgan Stanley.

Enjoy the video...

Read MorePlease enjoy this episode of the Alpha Exchange, my conversation with Jay Pelosky.

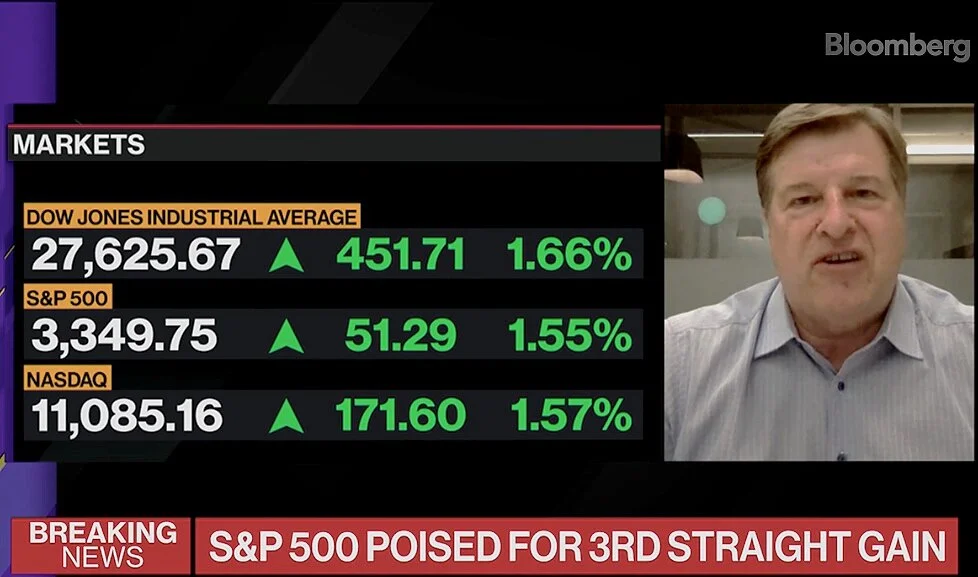

Read MoreJay discusses his latest investment & market outlook with Doug Krizner and Paul Allen on Bloomberg Daybreak Asia.

Read MoreAs we approach 2020’s 2H we remain constructive on risk assets based on 6 pillars of support: global policy, zero rates, economic bottoms, successful reopenings, bearish & underweight investors and scientific advancements.

Downside risks center around Covid-19 outbreaks sufficient to force renewed national lockdowns, US political risk & further escalation of US - China tensions beyond words to (tariff) actions.

Read MoreJay joined Bloomberg the open to talk about buying the dips.

Read MoreSenior editor Ash Bennington joins Jay Pelosky, CIO and co-founder of TPW Investment Management, to unpack his contrarian and bullish thesis on the economy and markets. Pelosky argues that the big plays for 2020 is not in tech, but in commodities, as well as in value stocks and cyclicals. He explains that the overwhelmingly strong stimulus, both in the forms of monetary and fiscal policies, have undergirded demand in a way that will allow it to spring back later in the year. Pelosky also discusses why this is the decade of Europe and ESG, the growing appreciation for EM currencies, and the potential headwinds that might dampen the current broad appetite for equities. In the intro, Jack Farley reviews the Fed’s latest press release and delves into some of their rate forecasts and economic projections.

Read MoreSpeakers: Jay Pelosky, CIO, TPW Investment Management & Anthony Ginsberg, Founder of Gins Global Investment Management

What kind of world we will find post lockdown? Which sectors will thrive and which will have been fatally weakened? Will many of the changes to the way we live, work and consume become permanently embedded features of our new world? How should investors best position their portfolios?

Read MoreAs we approach 2020’s 2H we remain constructive on risk assets based on 6 pillars of support: global policy, zero rates, economic bottoms, successful reopenings, bearish & underweight investors and scientific advancements.

Downside risks center around Covid-19 outbreaks sufficient to force renewed national lockdowns, US political risk & further escalation of US - China tensions beyond words to (tariff) actions.

Read MoreJay discusses his latest investment & market outlook with Doug Krizner and Paul Allen on Bloomberg Daybreak Asia.

Read MoreJay discusses how the Europeans need to use this opportunity to unite and what other signposts to look for to see a more robust recovery.

Read MoreJay quoted in an article by Natixis’s Nick Elward looking at both the bull and bear case moving forward

Read MoreOverview:

The past month has marked one of the most tumultuous periods in financial market history. It's been all about speed: the speed of the Covid-19 spread, the speed of the machine driven financial market response and finally the speed of the policy response.

This period has ended: deleveraging is complete, volatility has ebbed and there is finally time to think: of health, economics, politics, policy and markets: the components of our Global Risk Nexus (GRN) process.

Read MoreSpeakers: Jay Pelosky, CIO, TPW Investment Management & HANetf, Kevin Carter, Founder & CIO of EMQQ Index

The coronavirus spread has been relentless and has now gone global impacting every corner of the world’s economy, causing extreme market volatility and large sell-offs, leaving many investors feeling disorientated. As the markets grapple with the fallout, we’ll discuss the opportunities being created by the new quarantine economy and identify where investors should best position themselves to benefit over the long term.

OVERVIEW

Whipsaw city as fastest ever swing from all time high to bear market (16 days), OPEC + unravels & Biden comes back from the dead. Coronavirus spread & financial machines both too fast for policy makers. Containment solution carries immediate and significant economic cost - must be offset by policy action, failure to do so leads to volatility spikes, massive deleveraging and risk asset weakness.

Lack of global leadership means rolling thunder of individual country policy action. No place to hide: US equity still not cheap, Credit impaired, UST overbought & Commodities trying to find a floor. We have de risked and added to cash.

We are watching 4 factors: peak EU/US caseload (unlikely for weeks - esp in US); EU - US policy response (too little too late so far); consumer confidence & job numbers (services =70% of DM economies); investor positioning (much cleaner) & cheap markets ( US equity still not cheap, ROW is).

ECONOMICS

From Reflation 2020 to sudden stop, oil price shock and plummeting inflation breakevens.

Global Q1 GDP to include China hit, Q2 to be hit by EU and US weakness. Policy action now could save 2H V shaped recovery off a lower base. Recession risks rise; BLoomberg US recession indicator past 50.

DM service sector underpinned our Lower for Longer Global Growth call; containment policy a service sector killer. China rebound affected by ROW slowdown.

POLITICS

As President, Trump has never been in more trouble than he is today; the US policy response to the virus has been abysmal, from testing to medical stockpiles to messaging. Joe Biden’s miracle in S Carolina has catapulted him to front runner status.

Presidents Xi and Putin are in a different camp: Xi took a victory lap around Wuhan while Putin hit two birds with one nyet, forcing Saudi Arabia into a dangerous game of chicken that will take the legs out from under the US shale industry.

POLICY

Policy makers playing catch up to virus spread and machine led market discounting - DM failure to embrace fiscal spending at generational low in rates boggles the mind. Lack of leadership visible at every turn.

Shift from a health crisis to an economic issue has occurred - policy makers need to ensure it doesn't morph into a financial market meltdown. Containment in both health & wealth.

MARKETS

Markets hate uncertainty, humans are uncertain, machines are not. There seems to be many more questions than answers.

Volatility storm, a week of 50+ VIX readings culminating in a reading of 72 - highest since 80 in 2008 leading to massive deleveraging and total fear as shift in sentiment is complete. GLD and AGG for sale.

US equity remains expensive, Credit imparied, UST overbought, Commodities left for dead.

Equities in correlation of one land, down 25% or so, what to do now? Unless we are heading to a 2008 scenario which seems unlikely, bulk of the downward price action seems to have taken place. What's happened has happened - focus forward.

Could the end of the bull bring about the leadership change to non US equity, Value and Cyclists? Or will we return to the same leaders once events stabilize - a question worth pondering in the days & weeks ahead.

Read More