As The Tri Polar World Turns - The Higher You Go, The Tougher It Gets

MACRO THEMES

Has the easy money already been made? That's the question I ponder in the baking heat of a Manhattan August. Granted July was spent in Aspen Colorado where the saying goes: the higher you climb, the harder it gets. Back at sweaty sea level in New York City, I wonder if the same might hold true for US equities breathing in the thin air of new all-time highs (ATHs). August is never pretty in NYC and this Covid year is no different though I am proud to hang my hat with those embracing, rather than fleeing, NYC!

2020 has to be one of the best adverts for the buy & hold strategy ever and a real challenge for those who advocate market timing. We are not even six months past the Covid crash and already Tech, the Covid Age’s clear winner, has led US equity to new all-time highs while the rest of the world finds itself in its familiar laggard spot (ACWX still 13% below 2018 highs). Virtually the only thing Covid 19 has failed to upend is US equity leadership. Might the sharp drop in the USD (largest in a decade) be a precursor?

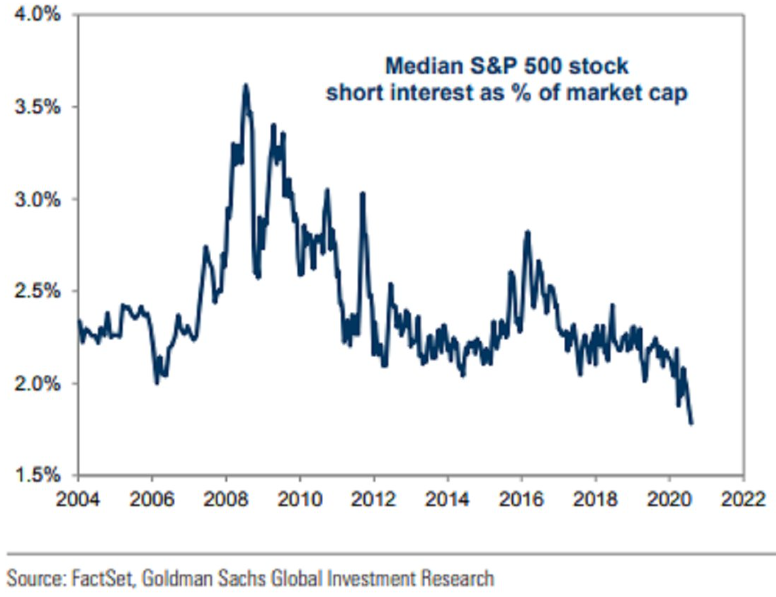

We try to let the market tell us what's happening rather than we tell it and this new bull market (Great Reopening link) deserves respect for climbing ever higher amidst an endless array of bad news. New ATHs during poor August seasonality is just the latest take this wall of worry and shove it moment. Epic short covering & a sellers strike provided assistance. Impressive. (Chart 1)

Chart 1: US Short Covering Fuel Runs Out

Source: Goldman

Now it's time to look forward to US schools reopening (hopefully), the run into year end and first thoughts about 2021. We expect the next three to six months to be tougher to navigate than the last with Tech & US equity quite extended. We remain constructive on risk over the coming quarters but would not be surprised by a (healthy) pullback & have been taking profits on the Tech side of our Tech - Value barbell while adding cyclicality.

Investors have a narrow path to walk given the equity run up. Over the coming months, we expect three big issues to stand out: the fate of the US stimulus package, the outcome of US elections & the deployment of rapid testing and perhaps a vaccine itself. It's unlikely the same portfolio that won the day ytd will be the one to lead in the coming six months.

We have approached risk assets using our Covid investing formula: control the virus > successful reopenings > domestic demand recovery (key given global trade decline) > stock market outperformance. China/Asia and Europe are the poster boys for this approach over the past 3 months or so.

The counter to the Covid formula is also important: failure to control the virus > sluggish reopenings > slow domestic demand recovery > need for more stimulus > rising political risk > weaker FX. To date, tech led equity outperformance has masked this US reality.

Let's assess how these next 3-6 months might play out, guided by our Global Risk Nexus (GRN) signposts: Health, Economics, Politics, Policy and Markets.

HEALTH

It's clear that controlling the virus is absolutely vital to being able to fully reopen the economy. Comparing the Tri Polar World’s three regional poles it's clear that Asia and Europe have done a far better job containing the virus than the Americas which as a region struggles even today to bring it under control. The apparent lack of concern regarding the broken US test and trace program (can't trace 40k + new cases a day) is worrisome for US implementation should rapid testing/vaccine become available.

While there are renewed case levels in several European countries the hospitalization and mortality rates are well below the levels of Spring. Asia seems in even better shape, especially China. Neither Asia nor Europe has anywhere near the case levels seen in the Americas.

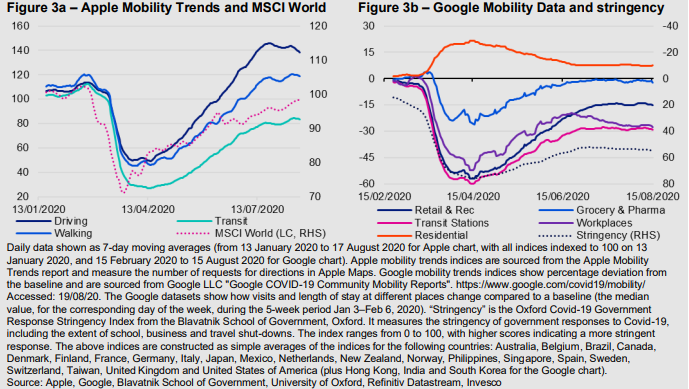

Speed is Covid 19’s signature: speed of spread, policy response, market reaction and now speed of science. It is likely that in the next few months both rapid testing and possibly a vaccine will be introduced, most likely in that order. Saliva based rapid testing could speed up the return of crowd events such as sports, arts, music while helping to restore in person learning to schools around the globe. (Chart 2)

Chart 2: Rapid Testing/Vaccine to Lift Consumer Risk Appetite

Source: Invesco

A vaccine by year end or shortly thereafter seems likely as several potential candidates are now in final Phase 3 trials. Which vaccine from which country comes first, how it is distributed, who controls it are all unknowns at this point but betting against the speed of science does not seem like a good bet. Risk assets are likely to react first and ask such questions later.

The key investment point is this: better Covid control through science is both likely and coming fast. It could upend many portfolios: that which has lagged will likely lead & that which has led is likely to lag. Thinking this thru and having a game plan is a great way to spend the tail end of summer 2020.

ECONOMICS

The Citi Global Economic Surprise Index at an ATH makes for a sharp contrast with negative and foreboding economic headlines. Global trade, down roughly 20% y/y in Q2, has derailed to such an extent that China, globalization’s main winner, now wants to implement a strategy of “dual circulation” where the focus shifts to internal rather than external demand.

Domestic demand is priceless in a weak trade world and so those countries able to stimulate it should recover faster & their risk assets do better than those that cannot. Thus the failure of US politicians to agree on increased stimulus is worrisome for growth as we consider Q4 and 2021. Our Covid formula suggests the US, with its haphazard reopening process, is most in need of stimulus.

We expect a stimulus package to ultimately be agreed upon, most likely in September but the delay & gamesmanship reflects perhaps a White House view that if the stock market is doing well then all is well. This in turn suggests a stock market swoon might be necessary to bring the political types to a deal.

Notwithstanding strong US data around housing & auto production there is the risk that a pullback in Govt support will lead to a pullback in spending and hence economic activity. Federal jobless support has halved between July and August. The Conference Board’s August consumer confidence numbers were the worst in six years while projections for purchases of major appliances and autos were the worst in 5 and 10 yrs respectively. Q3 US GDP will be roughly as strong as Q2 was weak - more important for risk assets will be growth in Q4 and Q1 2021.

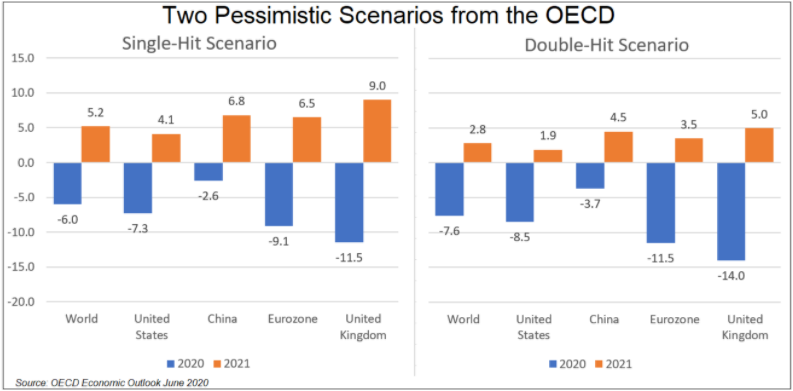

Europe, while handling the reopening process better than the US, has also had a few economic data hiccups of late, with PMIs coming in weaker than expected causing concern about whether renewed virus outbreaks may sink the European recovery. However, real time mobility data suggest continued economic recovery while Germany IFO survey reports “markedly more positive” outlooks. This is before Germany’s decision to extend its Kurzarbeit furlough program through YE 2021. (Chart 3)

Chart 3: European 2021 Growth Outlook Better than US

Source: OECD

Inflation concerns are already starting to percolate - appropriately so in our view. Should a vaccine manifest itself in the coming months, the potential for a near term demand spike, price rises & a bond market mini taper tantrum could surprise & have a dramatic portfolio impact.

POLITICS

There are two main risk areas, both US centric: the US election cycle and the growing US - China rivalry. The latter seems overblown while the former may be understated but not in the way most think.

Markets and investors hate uncertainty and if there is one thing that's certain its that Pres. Trump will bash China between now and Election Day - it's a central part of his campaign - made all the more so by his inability to (successfully) attack Joe Biden. This China bashing has been ongoing for years & both US and Chinese financial assets are proving impervious. The Chinese Yuan and stock market are among the world’s best performing assets in 2020, outperforming the US. Absent a shooting war or an attempt to boot China from the global financial system, more news/attacks on isolated companies etc are unlikely to derail either nations’ financial assets.

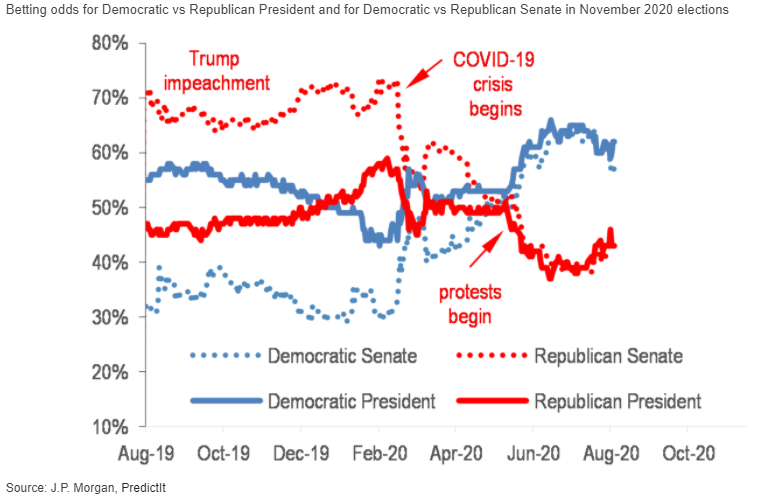

At this point the polls suggest its Biden's race to lose with good odds of a Democratic sweep of the White House, Senate and House. One underappreciated concern is that should the polls between Trump and Biden tighten, investors may worry that Trump will not accept a losing verdict if it's close, throwing the election outcome into doubt and reminding investors of 2000 but on steroids.

The likelihood of heavy mail in voting suggests it's quite likely that the election outcome won't be known till well after Nov 3rd. Political analysis suggests that much depends on how the popular vote breaks down; if Biden wins over 52% of the popular vote (H Clinton won 51%) it's highly unlikely the President can win in the Electoral College. (Chart 4)

Chart 4: Tightening Polls Are Bearish for Risk

Source: JPM

Thus tighter polls would suggest a tighter outcome which suggests potential for a disputed election & weaker US risk asset prices, especially as the President continues to rail that the only way he can lose is if the vote is rigged.

POLICY

Global monetary policy remains very supportive of financial markets, something that is unlikely to change over the coming months. Chair Powell’s Jackson Hole speech was as advertised with ST rates pegged, an asymmetric inflation target & implicit yield curve control. Fiscal policy, finally unleashed after a decade plus in the cupboard, has more room to work and is likely to remain the centerpiece of investor attention both in the US and abroad.

China’s dual circulation strategy is likely to accelerate Asian integration; as Chinese import demand grows it will become a more and more important market for its neighbors as well as Europe and others. One wonders why the US is so adamant at forcing China to become self reliant - it is likely to leave American companies shut out of one of the largest and fastest growing consumer markets in the world.

Splinternet is already leading China to develop a separate full tech stack. The financial sanctions push is costing New York big business as stakeholders flip their China tech holdings from NYC to Shanghai and the world’s largest IPO (Ant Financial) lists in HK and Shanghai & not on the NYSE.

Europe continues to drive its integration via the dovetailing of the Joint Recovery Fund (JRF), Green Deal & seven year EU budget. The potential for joint debt issuance leading to joint taxation across the digital and climate spaces allows one to imagine a powerful European renaissance in the years ahead.

The multi-year nature of all three of these programs suggest (pending ratification) that Europe’s medium term policy path is set - a stark contrast with Europe’s crisis filled prior decade: Greece, bank crisis, migrant crisis, Brexit, Covid etc. The Euro’s appreciation & growing private equity interest suggest some are already thinking this way. We see growing potential for the 2020s to be the Decade of Europe.

In contrast, the bare bones Republican Party convention platform suggests a Trump 2nd term will likely be more of the same. The Biden policy mix is much more fleshed out and will likely focus on putting people back to work, shoring up the safety net, infrastructure and climate though much depends on the vaccine trajectory. Tax hikes are also likely in a Biden administration though not in sufficient size to create great investor unease. (Chart 5)

Chart 5: Biden Tax Fears a Red Herring?

Source: JPM

More interesting is the possibility that a Biden Admin could be akin to the very active administration of Lyndon Johnson. Like Johnson, Biden is a man of the Senate who knows how to get things done; the prospects for a pragmatic and active Biden Admin are well worth contemplating.

From a Tri Polar World perspective, an active Biden Admin could be quite bullish for integration in the Americas. There is a real opportunity to leverage the push for supply chain reshoring to stimulate the integration process of N and S America. Instead of pushing re-shoring which will likely mean production returning but not jobs (due to automation) the US can encourage factories to set up in South and Central America and thus help deepen Hemispheric integration, employ people in their native countries and foster a more integrated regional approach, something Joe Biden is known to favor.

Covid 19, climate change and the US - China rivalry are accelerating regional deepening and integration. The shift in trade from global to regional and the need for smaller countries to move closer to the center in each region further reinforces the Tri Polar World. A failure to act by the US in the coming years would imply the Americas falling further and further behind Europe and Asia.

MARKETS

If the easy money has been made, what's an investor to do now? Tech has been such the place to be that the divide between Growth/Momentum and Value/Cyclicals is close to record wides. Elsewhere, the 10 yr UST is pushing up against an important chart line, Dr. Copper is breaking out & the dollar is trying to stabilize after a sharp decline.

Near term, equity markets, especially tech led US equity, are extended and ripe for a pullback - investors who have been bullish need to decide whether to take profits while those who have been sidelined need to decide whether and where to invest at ATHs. We think taking some profits make sense and would welcome a 5% pullback to perhaps set the stage for the broader rotation trade we believe to be necessary to move global equity prices appreciably higher. (Chart 6)

Chart 6: Extended US Equity at Risk to Pullback

Source: Datastream

Supporting a positive medium term perspective is a recent MS study on post Covid outlooks with four scenarios, three of which are positive with the bear case being no vaccine till 2025. In essence unless one can construct a strong no vaccine case it makes sense to stay invested - we agree - the question is invested in what?

We believe that more than Tech alone is needed to take the S&P significantly higher and sense a turning point towards the Cyclical/Value segments of the market. In fact, watching the daily action it seems like the two are handing the market off to each other - one day tech leads and S&P makes new highs, the next day it's the Cyclicals that lead the S&P to another new high. We expect higher equity prices over the six months but not without hiccups & believe technical analysis can be helpful in the current market environment.

Our view is that the Rotation trade is needed to broaden out the advance and sustain it. JPM notes that the current environment is quite different from history as rising manufacturing PMIs have not resulted in the normal Cyclical/Value/SC/non US outperformance. Tech being a clear Covid winner is one reason; another might be that Central Banks’ desire to keep rates low is retarding the typical back up in long duration rates that spurs the financials which are a big slug of most Cyclical/Value ETFs.

The US yield curve is much steeper today than a year ago and yet US financials (XLF) are roughly 5% or so below year ago levels and under 200day resistance which it has approached and failed twice since March. How stocks handle rising rates will be critical & much depends on why rates might rise: supply - demand imbalance, stimulus deal, a vaccine. The sharp rate backup a few weeks ago spurred a nice move into Cyclicals suggesting investors are primed for this signal.

Looking forward we expect a US stimulus bill and continued European fiscal support. We anticipate a tightening of US election polls and growing risk of a contested election that is negative for US assets. We also expect news of an approved rapid testing and vaccine protocol within the next several months.

With that backdrop we think the potential for a shift from Tech led equity markets to a Cyclical and Value led rotation is high and rising together with a concurrent shift from US leadership to non US Developed Markets. The Fed’s asymmetric approach to inflation, the passage of further stimulus, the advancing likelihood of Covid mitigation/protection are all supportive of a broad based advance in equity prices.

An environment where US equity does ok on an absolute basis is the best for ROW outperformance. The case is building for Tech underperformance on a relative basis if not an absolute basis as work from home sells off, the tech IPO calendar gets heavy, rates rise and Tech cash flows become less highly valued while Tech winnings are used to buy financials and industrials, materials and energy.

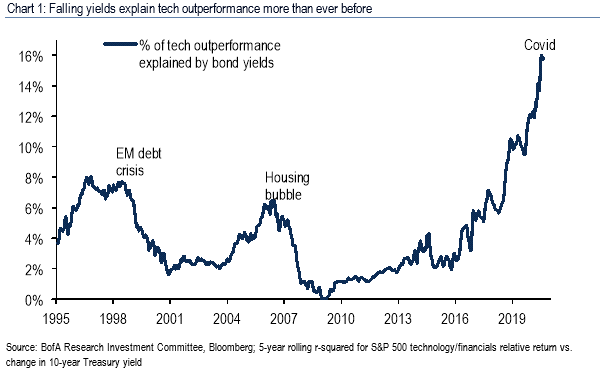

Evidence of Tech risk is growing with BofA noting that low rates explain over 15% of tech’s recent rise while JPM notes the negative correlation between Tech and rates. The essence of the Growth/Value trade is Tech vs Financials and rates are the fulcrum. (Chart 7)

Chart 7: Rising Rates Key to the Rotation Trade

Source: BofA

We remain overweight equity in a multi asset portfolio, overweight non US DM vs US and EM, prefer China and N Asia tech chains within EM and Cyclical and Value together with small caps in terms of styles/factors. Financials are especially favored. Non-US DM provides more Cyclical/Value exposure; the combination of a Trump 2nd term and a vaccine is likely to be quite bearish for US assets as the lack of a 2nd term program contrasts poorly with active European and Asian integration efforts while a vaccine reduces the appeal of US tech heavyweights.

Fixed Income is at an inflection point; one that might herald the end of the long bond bull market. If the world’s full throated fiscal and monetary support isn't enough to do it what is? A vaccine inspired taper tantrum in long dated Sovereigns seems quite feasible, especially given all the supply that is coming. The charts (TLT, AGG) look like they are rolling over; a 10 yr UST at 1.25 - 1.5% in the coming six months doesn't seem like a stretch, likewise a 10 year BUND yield with a + in front of it.

The Fed suggesting ST rates could remain near zero for five years, echoing the post GFC seven year stretch, while saying it could tolerate inflation above its 2% target suggests it wants to claim the bond vigilante mantle for itself. Thus we remain quite underweight Sovereigns with exception of EM $ debt, prefer Credit and within credit HY, continue to hold TIPs & Preferreds and are looking at RE vehicles. The search for yield in a bond bear market could have real ramifications for pension funds, risk parity strategies and 60-40 portfolios who have long benefited from the twin stock - bond bull markets.

Within FX the question is whether the recent big moves in the USD and Euro are signaling a shift in relative fortunes and a precursor to how equity leadership might play out. We are sympathetic to this view and would be even more so in the event of a Trump 2nd term. US financial assets are the most over owned in the globe and have been huge beneficiaries of capital inflows from abroad. As the lines of distinction are drawn between US governance and that of Asia and Europe those flows could be at risk, leading to FX repricing. In the Tri Polar construct one can start to see outlines of regional currency blocs: the euro, yuan and dollar.

We continue to see upside for Commodities which remain significant relative underperformers with the exception of precious metals. A rate hike would dampen the ardor for gold/silver while inspiring it for industrial metals. We have recently taken profits on gold/miners. The move to clean energy and ESG driven investing strongly suggests clean energy needs to be a part of one’s commodity picture, especially with a Biden presidency. Old energy is tricky and seems less appealing while interest in agriculture is growing.

I hope you find this monthly piece of value and look forward to engaging with you on a monthly basis as we move through 2020.

Jay Pelosky, CIO & Co-Founder

TPW Investment Management

DISCLOSURE:

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts are inherently limited and should not be relied upon as an indicator of future results. There is no guarantee that these investment strategies will work under all market conditions, and each advisor should evaluate their ability to invest client funds for the long-term, especially during periods of downturn in the market. Some products/services may not be offered at certain broker/dealer firms.

There can be no assurance that the purchase of the securities in this portfolio will be profitable, either individually or in the aggregate, or that such purchases will be more profitable than alternative investments. Investment in any TPWIM Portfolios, or any other investment or investment strategy involves risk, including the loss of principal; and there is no guarantee that investment in TPWIM’s Portfolios, or any other investment strategy will be profitable for a client’s or prospective client’s portfolio. Investments in TPWIM’s Portfolios, or any other investment or investment strategy, are not deposits of a bank, savings and loan or credit union; are not issued by, guaranteed by, or obligations of a bank, savings and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency.

The investment descriptions and other information contained in this are based on data calculated by TPW Investment Management, LLC (TPWIM) and other sources including Bloomberg. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. This report should be read in conjunction with TPWIM’s Form ADV Part 2A and Client Service Agreement, all of which should be requested and carefully reviewed prior to investing.