As The Tri Polar World Turns - Health & Wealth

MACRO THEMES

Our 2020 outlook piece: Reflation 2020 held the view that the global manufacturing slowdown had ended and European growth was picking up. February data support that perspective but then Covid-19, a true black swan, swam into the picture, upending the global economy and markets in an unprecedented fashion, resulting in one of the most tumultuous periods in financial market history. It's been all about speed: the speed of its spread coupled with the speed of the machine led financial market response & finally the speed of the policy response - the combination of which led to daily record breaking across assets and geographies. This period has concluded: markets have stabilized, deleveraging is complete, volatility has ebbed & the famed bear market correlation of 1 is breaking down. There is finally, as we wrote recently, time to think about the future: of health, the economy, politics, policy & markets: the components of our Global Risk Nexus (GRN) process.

HEALTH

As part of our Covid-19 adjustment, we added a health section to our regular GRN work, work we have found extremely useful over the past few years and particularly the past six weeks. Covid-19 is first & foremost a health challenge which sets the stage for the rest. The health news is clearly getting better as mass testing (S Korea, Taiwan) and containment (China, EU, US) successfully slow the virus: China has fully reopened and other parts of Asia are following suit; European and American case curves are flattening and after much sadness and sorrow the focus is shifting to the reopening process. Here in NYC hospitalizations are down sharply - thankfully the worst fears were not realized as New Yorkers put aside their traditional individual bent and got in line (with 6 feet between each other).

Going forward, we expect China and other Asian countries, those first in & out, to serve as models at both the country/state level as well as the corporate level. Humans are (hopefully) learning animals and having a first in, first out process we believe will be helpful. Starbucks, for example, plans to utilize processes learned from reopening 90% of its China locations to reopen in the US and Europe. We expect fever checks, mandatory masks and gloves will likely be de rigueur for many once US production restarts.

As Dr. Fauci of the US has said, the virus controls the timeline. We expect the re-opening process will be slow and proceed in fits and starts - much as the lockdown process occurred here in the US and in Europe. The good news is that several European countries: Denmark, Austria, Germany, Italy, Spain have begun the re-opening process. Watch the cross border transport of goods; domestic travel is likely to be slow and international even slower given numerous Asian incidents of imported cases. Managing a two front strategy: both the virus and the economic restart will be challenging. The bad news of social distancing is that societies do not build up herd immunity.

This lack of herd immunity means the one constant everywhere will be testing, testing, and more mass testing. Worryingly, this is an area where the US has really struggled. It's hard to understand how the richest country on earth, one that spends more, per capita and in GDP terms, than any other on health cannot seem to get above 150k tests per day. Estimates are that the US will require upwards of 1M tests per day together with the ability to read the tests in order to fully reopen. On the good news side Abbott has announced that its antibody test is ready to ship; it expects to ship 4M in April with a run rate of 20M per month by June. Longer term, vaccines are clearly being sought after; the WHO notes that there are 70 different trials underway globally. The world’s best scientists and technologists are focused on Covid-19; don’t underestimate their likely success. We expect the reopening process to be fully underway within the month across both the US and Europe. (Table 1)

Table 1: Re Opening to Be a Gradual Process

Source: Axios

ECONOMICS

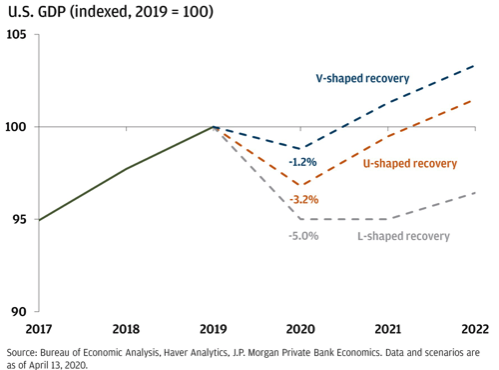

The Covid-19 recession stems from an economic sudden stop that puts the bad news up front, meaning the data falls off a cliff, fast & furious, unlike normal recession where bad news builds over time. US jobless claims peaking within five weeks stands as exhibit one. Covid-19 together with the OPEC+ oil shock has resulted in once unthinkable economic numbers becoming both commonplace and priced in (Did one ever think one would see a -30% Q/Q GDP estimate?). China's weakness should derail Q1 Global GDP and the US and EU to derail Q2. China’s -6.8% decline in Q1 GDP Y/Y was better than expected; more informative is the March data which revealed worse than expected retail sales offset by better than expected IP. That split suggests stimulating demand might be the big challenge once economies re open. Estimates for Q2 US/EU GDP are breathtakingly negative but with a near complete shutdown in economic activity the numbers make a strange kind of sense. (Chart 2)

Chart 2: US Economic Recovery: Between V & U

Source: JPM

Perhaps more importantly from an investment perspective, we expect a 2nd Half Global GDP recovery, led by Asia and supported by the US and Europe. China has recovered to 85% or so of capacity and March trade/production data were better than expected; we expect China to focus on domestic demand using vouchers and other online efforts to bring back consumption. We are inclined to be in the letter V or U camp, defining a V as the amount of time it takes to get out of the recession is = to or less than the time in recession. It seems quite likely that with the US and European economies restarting in May - June that Q3-4 GDP will be strongly positive on a Q/Q basis and perhaps even on a Y/Y basis, particularly in the case of Europe. It is difficult to do more than speculate on the economic impact and outlook given the unprecedented nature of the event and policy maker response.

The IMF just released its revised global growth forecast, calling for a 3% Global GDP decline this year, far worse than 0.1% decline in 2009. Note also the strong rebound with global growth approaching 6% in 2021, the strongest growth in 40 years. It may make sense to have more confidence in 2021 forecasts than 2020 given that as time passes we will know more, more about how to mitigate if not eliminate Covid-19 and more about the ability of various countries to return to growth. (Chart 3)

Chart 3: Global Growth, Down then Up

Source: IMF, Bloomberg

POLITICS

Covid-19 will have a significant impact on global politics. Big Government is back. Many governments have been caught out by the speed of the virus spread and in today's social media world much of what was said will be on endless loop come election time. Speaking of elections, South Korea, a leader in mass testing, just held national elections during a pandemic; voter turnout was the best in nearly 30 years & President Moon’s decisive victory reinforces our view that how leaders respond to the crisis will strongly influence their political fortunes.

From a TPW perspective, China is clearly seeking to bolster its soft power image, shifting from its initial slow and subpar reaction to advising others on how to contain the virus and using its factory to the world capacity to send much needed supplies to many nations including the US. China’s Asian outreach is most evident with groups such as ASEAN+3 as well as via Pres. Xi’s regular calls to world leaders. In contrast, Europe’s leadership is focused internally while the US is busy sending messages such as its decision to freeze WHO funding during a pandemic. South American leadership has also been MIA at best.

Covid-19 provides Europe with a real chance to deepen its integration via how it handles the virus aftermath. Its state by state health care approach has been found wanting and could be one area of further integration but the financing of economic recovery is where a pan European approach could have real value. Access to the European Stability Mechanism (ESM) & other recent funding/financing decisions are good steps forward. Europe’s ability to tie its fiscal response to its Green Deal climate initiative could be a game changer.

The US response to the virus at the federal level has been poor across the board - from testing to messaging to the embarrassing lack of PPE, none of it has been good. The healthcare system has likewise had a less than stellar crisis. The front line doctors, nurses, aides etc. are indeed heroes and I have been proud to clap every night at 7 pm with my fellow New Yorkers but the system itself clearly needs fixing. The flexible US labor model seems almost cruel when 22 million are out of work in a matter of weeks while many lose their employer tied health insurance to boot.

Medicare for all and UBI - fringe items a few years ago, Democratic debate talking points a few months ago now seem almost like no brainers as the Federal Govt sends every American (pretty much) a $1200 check in the mail. The shift from wealth concentration to wealth distribution is under way. The US presidential race is now down to the final two, the incumbent and Joe Biden the challenger. The outcome will likely depend on who the electorate sees as a safe pair of hands. Recession and bear markets tend to be the death of incumbents and 2020 will bring both for Donald Trump.

POLICY

The bad news has been the lack of global coordination at any level. The good news has been what we have called the Rolling Thunder (link) of individual country responses. Moving with unprecedented speed and scale, Central Banks and Governments alike have combined to put a floor under both their citizens' economic well-being as well as financial markets.

There is little doubt that saving Main St during a global pandemic is easier than bailing out Wall St yet having the GFC playbook at hand has been a great benefit. Financial markets have clearly taken on board that policy makers will do whatever it takes to stabilize the global economy. We believe that is, and will continue to be, the case for the immediate future. If containment extends beyond Q2 we would expect that to be problematic for citizens, policy makers & investors alike. (Chart 4)

Chart 4: Rolling Thunder of Policy Response

Source: IMF, Bloomberg

In our January monthly we updated our Tri Piolar World outlook to include technology and climate as two new drivers. (TPW 3.0 link). The old saying: never let a good crisis go to waste would seem appropriate here… putting folks back to work while positioning for a low carbon future would seem an interesting opportunity set. As noted, Europe would seem to be best positioned.

One can argue all one wants about the Fed capturing the bond markets or MMT or whatever one wants but the reality is that as an investor one plays the hand one is dealt and the current hand is one that includes a lot of Central Bank and Govt intervention. From this armchair thank goodness because as in September 2008, the mid to late March 2020 deleveraging, if left unchecked, would have ensured that a health crisis would have morphed into a systemic financial crisis.

We expect that the various policies implemented around the globe will be sufficient to stabilize the citizens’ economic well-being over the current quarter. Governments are likely to join health care professionals in playing whack a mole with policy needs and fixes. China retains much of its policy dry powder and while its total social financing expanded significantly in March one expects more to come, perhaps with Q1 GDP data. We do not expect anything along the lines of China’s 2009-10 stimulus package given the host of problems that intervention created, ranging from pollution and corruption to SOE zombies.

MARKETS

The mental gymnastics required to respond to bull market peaks to bear market collapse back to bull markets in under two months have been Olympic level. Thankfully markets have stabilized; we believe the equity lows are in and with near term GDP and EPS numbers a guessing game and likely discounted the focus should be on market technicals to guide tactical positioning. Markets typically bottom a quarter or so before the end of recession, supporting this timing as well. (Chart 5)

Chart 5: Markets Typically Bottom Before Recessions End

Source: JPM

The market has continued its time honored process of making the most people upset with a relentless up move, taking most markets back above the 20 day moving average and filling in the deleveraging puke. Arguably many equity markets are in new bull markets, up 20-25% or more from the late March lows. We expect more of a range bound market over the next few months. The shift from deleveraging to rebalancing and from volatility targeting to short covering has been swift, suggesting a less appealing risk reward profile. One could say the easy money, such as it is (and it's never easy) has been made. The good news is that easing volatility helps deepen markets and improve liquidity. (Chart 6)

Chart 6: Leverage & Volatility Always Leads to a Hangover

Source: JPM

Don't fight the Fed once again proves its (investment) worth in FI. The wild swings in UST and IG credit have calmed and the aggressive flows that led various credit ETFs to trade at both large discounts & premiums have stabilized. The Fed’s decision to buy both IG and some HY has been a true game changer. The recent opening of the HY market has led some analysts to expect a default rate under 10% in 2020, much less than in 2009.

Commodities remain beaten down and even the OPEC+ deal has been unable to lift the oil price in any measurable way, much to the chagrin of all involved. Dr. Copper acts a little better as China based inventories fall - whether its seasonal or fundamental remains to be seen. Commodities offer the most leverage to an economic recovery. Gold and gold miners have been standouts; in a low rate world where MMT seems to be the guiding theory, if not practice, gold makes sense. The gold/oil ratio is off the charts, suggesting an oil bottom is likely around current levels. (Chart 7)

Chart 7: Commodities Lag Rebound

Source: JPM

Risks remain: namely, a 2nd wave of cases leading to an extended containment that requires more Govt action & risk political infighting. The longer the duration of containment and lockdown the tougher it will be for Govts, markets and societies to hold it together. Signposts to watch: the pace and success of reopenings, the continued rollout of economic stimulus, China’s ongoing recovery, testing & vaccine success.

PORTFOLIO STRATEGY AND ASSET ALLOCATION (GMMA)

We hold a slight Equity OW with a Tech/Value barbell and bias to non US DM. We see stocks as growth vehicles with yield in a yield starved world and note the S&P/UST ratio is at an ATL. Pay attention to Japan with its cash rich companies, cyclical exposure and potential for revaluation if the rest of the world joins in a MMT effort (Chart 8). Within EM equity we favor China with its first in, first out characteristics, its abundance of dry policy powder, its role as a major beneficiary of low oil prices and its capacity to drive domestic demand via its online capacity coupled with its ability to turn on and off certain segments of its country. We are UW Bonds with a focus on Credit, Pref, TIPs, EM $ debt and while watching Commodities carefully we remain UW with a sizable Gold position together with a healthy cash position.

Chart 8: Pay Attention to Japan Equity

Source: FactSet

Two big questions remain: will the bear market and global recession lead to a new bull market with new leadership, meaning non US instead of US equity and Value over Growth, Cyclicals over Defensives? The poor US response to Covid-19 coupled with the sharp reduction in stock buybacks suggest some of the US premium valuation may be at risk. Secondly, was Reflation 2020 simply interrupted and will the 2H of the year and 2021 be a reflationary period? We lean toward yes in both cases and are watching the USD as a signal flare for cross asset direction.

I hope you find this monthly piece of value and look forward to engaging with you on a monthly basis as we move through 2020.

Jay Pelosky, CIO & Co-Founder

TPW Investment Management

DISCLOSURE:

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts are inherently limited and should not be relied upon as an indicator of future results. There is no guarantee that these investment strategies will work under all market conditions, and each advisor should evaluate their ability to invest client funds for the long-term, especially during periods of downturn in the market. Some products/services may not be offered at certain broker/dealer firms.

There can be no assurance that the purchase of the securities in this portfolio will be profitable, either individually or in the aggregate, or that such purchases will be more profitable than alternative investments. Investment in any TPWIM Portfolios, or any other investment or investment strategy involves risk, including the loss of principal; and there is no guarantee that investment in TPWIM’s Portfolios, or any other investment strategy will be profitable for a client’s or prospective client’s portfolio. Investments in TPWIM’s Portfolios, or any other investment or investment strategy, are not deposits of a bank, savings and loan or credit union; are not issued by, guaranteed by, or obligations of a bank, savings and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency.

The investment descriptions and other information contained in this are based on data calculated by TPW Investment Management, LLC (TPWIM) and other sources including Bloomberg. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. This report should be read in conjunction with TPWIM’s Form ADV Part 2A and Client Service Agreement, all of which should be requested and carefully reviewed prior to investing.