A special live with true experts: Roberto Attuch Jr, CEO of OMINVEST, and Jay Pelosky, strategist with more than 30 years of experience in about 50 countries around the world.

Read MoreExecutive Summary

Clarity on the Big Three issues: US stimulus, elections, and vaccines is coming quick. Expect clarity to result in sizable cross asset price shifts, stimulate the equity Rotation Trade & capsize the long bond bull market.

US stimulus a when not if question. Sizing depends on election outcomes; polling suggests a Democratic sweep (Blue Wave) and a sizable fiscal package (think House bill $2T) early in 2021. Speed of science suggests at least one approved vaccine shipping before YE.

Continue to expect a global economic BOOM in 2021 led by record liquidity, further stimulus, and vaccines. Covid upends the experience economy & stimulates the buy stuff economy. Watch for inflation scare, expect sharply higher UST rates at the long end. Rates are the fulcrum for the Rotation Trade, a trade both sectoral/style & geographic in nature.

Risks center around contested US elections, US Govt gridlock, fiscal fatigue in Europe.

HEALTH

Expect Pfizer Phase 3 trial results in coming weeks, Moderna in Nov, China candidates around the same time frame. Production underway in all cases, distribution to leverage logistics advances of the past decade. Cases high, deaths much lower result in US/EU targeted lockdowns. Staggering Asian Covid outperformance.

ECONOMICS

2021 Global economic boom built on record global liquidity & AIT, IMF approved fiscal stimulus, robust US - Chinese consumption & vaccine success. US stimulus sizing election dependent. Europe must avoid fiscal fatigue & execute on policy. China is the only major economy to grow in 2020.

POLITICS

Biden lead in place for months - electorate looking for a safe pair of hands post Covid debacle. Massive early voting tilts Democrat. Will Republican lead in new voter registration make a difference? Expect results by Nov 4th. Senate the main focus - US gridlock V problematic in a fast changing world.

POLICY

Monetary policy led by AIT, how high will the Fed let long rates rise? Fiscal policy in the driver's seat. Biden's plan scores as pro growth. Demand for EU joint issuance suggests hunger for EU safe assets - execution is EU key. China’s DCS and RMB strength provide both domestic & global economic support.

MARKETS

Clarity on Big 3 brings money off sidelines, catalyzes equity Rotation Trade & capsizes FI long duration bull market. Prefer Cyclical/Value, non US DM equity. Watch for Tech “kryptonite”. Cross asset pricing is just starting to reflect these new realities… much further to go - avoid “duration complacency” at all costs! Potential for much wider equity price swings than expected given months of range trading. Expect USD weakness and commodity strength, old energy could be a mispriced opportunity.

Read MoreExecutive Summary

Has A much needed and healthy risk asset correction may turn into something more malign given US centric, self inflicted wounds. Regime changes are in train across the board: equality, climate, policy, politics & thus markets.

Fed Chair Powell begging Congress for more stimulus while the US President questions the peaceful transition of power is, shall we say, not a good look. Yet all is not lost. While we wave goodbye to the Fed put we say hello to the Mnuchin plunge protection team - down 10% and the call goes out.

US equity risk reward seems poor going into a contested election with Tech exposed to vaccine “kryptonite”. Rotation interrupted, not reversed; post election stimulus likely. We remain with a Cyclical/Value tilt and non US equity bias. Long duration Sov debt at risk to a mini taper tantrum & possible bear market. We are dollar sellers on the bounce and continue to favor Commodities including industrial metals/miners & clean energy.

HEALTH

Good news, bad news. The good: rapid testing is here and vaccine trials remain on track for a vaccine in coming months. Bad news: US has abdicated on the federal level and case levels are rising sharply in parts of Europe. Better Covid control through science is coming fast & will upend portfolio structures.

ECONOMICS

Good news & bad. The good: a global synchronized upturn is underway, supported by record setting global liquidity. The bad: more, politically difficult, fiscal support is needed, especially in the US. Regime change is never easy.

POLITICS

Political risk is US centric - any Qs, ask President Trump. BIden’s lead has been constant for much of the past year. Better polling quality & no 3rd party candidate suggests it's his race to lose. Surprise would be a smashing, Election night, Biden win - watch Fla.

POLICY

We have entered both Peak Central Bank territory & the more politicized world of Fiscal Policy. China’s DCS, Europe’s furlough program & US pandemic support all the same policy - support/grow consumption. China, Germany, US drive the Tri Polar World of Asia, Europe & the Americas.

MARKETS

Tech selloff clears the froth away. Rotation trade (both sectoral/style & geographic) remains the focus. Imminent vaccine, synchronized global recovery & abundant liquidity support risk assets on a 12 month basis. New inflation regime to impact pension, risk - parity, 60-40 funds. Regional FX blocs centered around USD, Euro, RMB coming into focus.

Much, much more inside.

Read MoreIn 7 minutes, Jay covers the Rotation Trade - both sectoral and geographic, US election risk, Asian equity market outlook and an ESG/green energy ETF opportunity.

Read MoreTight 4 min clip where Jay goes cross asset with Jon Ferro: equity, FX, bonds, explains why a vaccine is tech kryptonite and highlights the Rotation Trade taking place underneath the Tech selloff - the real key mkt action.

Read MoreWhat can investors do when the easy money has already been made? Managing editor, Ed Harrison, explores this question and more with Jay Pelosky, chief investment officer and co-founder of TPW Investment Management. Pelosky shares with Harrison his base case for China, Europe, and the U.S. as well as emerging markets, and he describes as what he sees as weakness in the long-end of the U.S. Treasury yield curve. Pelosky and Harrison then discuss how a successful vaccine would affect specific sectors of the market, such as tech and industrials. Finally, after sharing his thoughts on how the 2020 election would impact markets, Pelosky analyzes the potential new geopolitical coalitions that could form should deglobalization continue.

Read MoreXXXXXXXXXXXXX

Read MoreJay Pelosky CIO sat with Fabian A. Onetti Founder of Winston Capital Advisors who brings 30 years experience in banking with 24 at Morgan Stanley.

Enjoy the video...

Read MorePlease enjoy this episode of the Alpha Exchange, my conversation with Jay Pelosky.

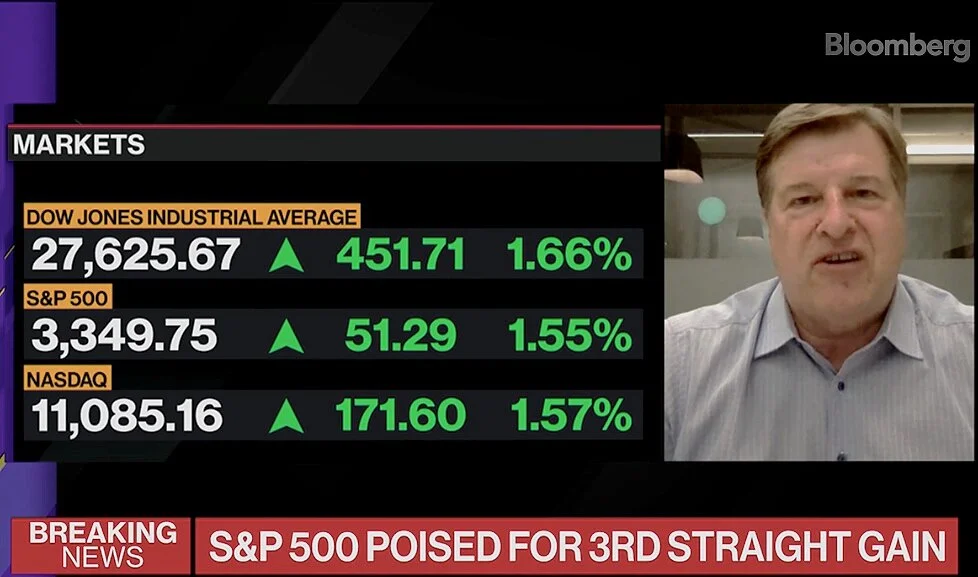

Read MoreJay discusses his latest investment & market outlook with Doug Krizner and Paul Allen on Bloomberg Daybreak Asia.

Read MoreAs we approach 2020’s 2H we remain constructive on risk assets based on 6 pillars of support: global policy, zero rates, economic bottoms, successful reopenings, bearish & underweight investors and scientific advancements.

Downside risks center around Covid-19 outbreaks sufficient to force renewed national lockdowns, US political risk & further escalation of US - China tensions beyond words to (tariff) actions.

Read MoreJay joined Bloomberg the open to talk about buying the dips.

Read MoreSenior editor Ash Bennington joins Jay Pelosky, CIO and co-founder of TPW Investment Management, to unpack his contrarian and bullish thesis on the economy and markets. Pelosky argues that the big plays for 2020 is not in tech, but in commodities, as well as in value stocks and cyclicals. He explains that the overwhelmingly strong stimulus, both in the forms of monetary and fiscal policies, have undergirded demand in a way that will allow it to spring back later in the year. Pelosky also discusses why this is the decade of Europe and ESG, the growing appreciation for EM currencies, and the potential headwinds that might dampen the current broad appetite for equities. In the intro, Jack Farley reviews the Fed’s latest press release and delves into some of their rate forecasts and economic projections.

Read MoreSpeakers: Jay Pelosky, CIO, TPW Investment Management & Anthony Ginsberg, Founder of Gins Global Investment Management

What kind of world we will find post lockdown? Which sectors will thrive and which will have been fatally weakened? Will many of the changes to the way we live, work and consume become permanently embedded features of our new world? How should investors best position their portfolios?

Read MoreAs we approach 2020’s 2H we remain constructive on risk assets based on 6 pillars of support: global policy, zero rates, economic bottoms, successful reopenings, bearish & underweight investors and scientific advancements.

Downside risks center around Covid-19 outbreaks sufficient to force renewed national lockdowns, US political risk & further escalation of US - China tensions beyond words to (tariff) actions.

Read MoreJay discusses his latest investment & market outlook with Doug Krizner and Paul Allen on Bloomberg Daybreak Asia.

Read MoreJay discusses how the Europeans need to use this opportunity to unite and what other signposts to look for to see a more robust recovery.

Read MoreJay quoted in an article by Natixis’s Nick Elward looking at both the bull and bear case moving forward

Read More