As The Tri Polar World Turns - Clarity Cometh - Are You Ready?

MACRO THEMES

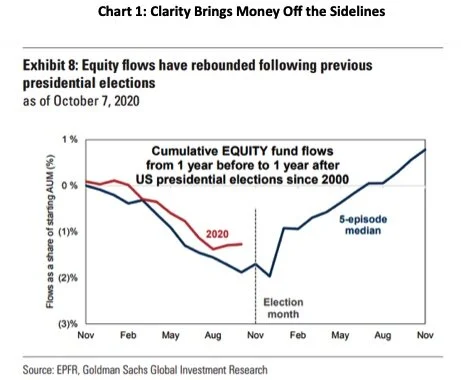

The end game is approaching for the three main uncertainty generating issues of the past few months: US stimulus, US elections and vaccine timing. The lifting of all three issues in a space of a few weeks suggests the potential for significant cross asset price shifts. The number of trees sacrificed to opine on these three subjects must be off the charts. I, for one, can’t wait to move on to some new topics. (See Chart One)

Our expectations remain pretty straightforward – stimulus is a when not if question whose size depends on whether there is a Democratic sweep (Blue Wave) in the US elections. Polling suggests the Blue Wave as base case; with less than two weeks before Nov 3rd; there is little to suggest a major shift in the race. We have noted Covid speed since March; the speed of science suggests that at least one or two vaccines will likely be approved and starting to ship before YE. We covered all three issues on Bloomberg TV last Friday.

Our global, cross asset investment thesis builds on this perspective – we expect higher interest rates, especially at the long end pf the UST curve, to finally catalyze the stealth Rotation Trade that has been underway for months, lifting Financials and hurting Tech. This appears to be taking place as we write with the 2/30 year spread finally breaking beyond 140bp after several failed attempts. Rates are the fulcrum for the rotation trade, a trade that is both sectoral and geographic; we continue to expect the more cyclical markets of Europe and Japan to perform better than the US over the coming year. We have grown increasingly comfortable with our 2021 global economic boom outlook (more next month), supported by record global liquidity, continued fiscal support, the Chinese and US consumer and a vaccine. (Setting Up for a 2021 BOOM). Stimulus, rising rates and vaccines are “kryptonite” for tech as we have noted. We expect a weaker USD & higher commodity prices.

Besides the risk of the above base case proving wrong (contested election, gridlock) there are two other risk elements recent conversations suggest should be highlighted. One is the “duration complacency” that exists among the fixed income investor community given the long trend of steadily lower rates. The shift in rates we note above, coupled with potential inflation fears and exacerbated by likely record breaking Sovereign & quasi sovereign issuance in 2021, could lead to much higher interest rates at the long end than investors currently contemplate. Will the Fed cap rates at 1.5% on the 10 yr. UST or 2.5%; will the 30 yr. UST rate peak at 2% or 3%? We take the over.

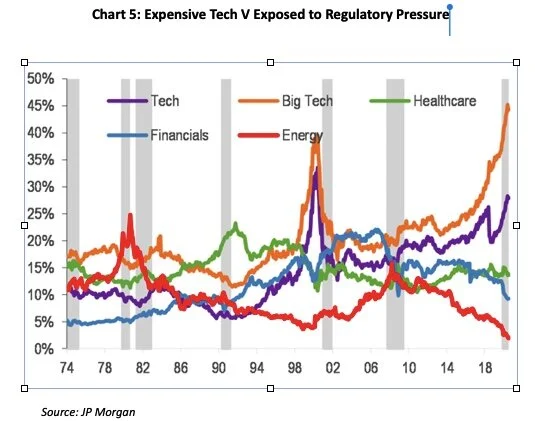

The second relates to the potential for style/factor shifts to be much bigger than investors currently expect. Could the Growth-Value pendulum for example swing widely to the other side or will it stop in the middle? Will US Financials trade at 1.5x BV or 2x, will EU banks trade at .75x BV or over 1x? Will US tech maintain its lofty valuations in the face of ebbing WFH, the ecommerce growth desert that could result from the “pull forward” of Covid, the back up in rates and the rise of regulatory pressures, regardless of who wins in a few weeks?

After months, weeks and now days the time for clarity is approaching. Potential asset price swings an order of magnitude larger & faster than investors of all stripes, retail and institutional, long and short, risk parity, tactical and strategic expect, is what we need to think about, focus on and position for. We continue to be guided by our Global Risk Nexus (GRN) signposts: Health, Economics, Politics, Policy and Markets

HEALTH

While case counts mount in both Europe and the US, Asia extends its success in combatting Covid, with life returning to near normal in China and elsewhere. The gap between life there and life in the US and Europe widens on a near daily basis. National lockdowns of the type seen in the Spring remain unlikely; in their stead there is growing acceptance and use of short, strict and geographically limited lockdowns as seen in NYC and in parts of Europe. While case counts have risen to new highs in many areas, hospitalizations and deaths in particular are down sharply from the Spring thanks to asymptomatic cases & improved Covid 19 treatment protocols. (See Chart Two)

The US & Europe seem to have decided to simply mitigate the disease until a vaccine or vaccines are ready to be deployed. The time to emulate China & eradicate the disease has passed. We are in this kind of grey world, not fully overwhelmed by the virus and health policy response as in the Spring but with nearly all aspects of life remaining overshadowed by Covid 19 and the health policy response.

A vaccine is clearly needed to return to “normal” life; the good news is that such vaccines would seem to be imminent. Pfizer, for example, expects to know the efficacy of its vaccine candidate by month end and sees a path to emergency use approval by the end of Nov. Production is already well under way. Moderna expects to learn if its vaccine is successful next month while China has four vaccines & over 60,000 people in Phase 3 trials. It too expects results soon and is already producing doses.

Once approved the need to distribute the vaccine becomes key and here too the news is pretty good. Pfizer plans to have 100M doses ready in 2020 and 1.3B in 2021. It has outlined a very sophisticated distribution process in both the US and Europe to move its vaccine which is likely to need special cold temperature controlled handling. So while the vaccine distribution effort will be one of a kind it’s important to note that global logistics and package delivery has also become a completely different animal over the past decade.

Speed has been and remains Covid 19’s signature: speed of spread, policy response, market reaction and now speed of science. In addition to vaccines, rapid testing is up and running with airlines, sports teams and others pressing for more usage in order to stimulate consumer activity. Major European airports are currently introducing rapid testing processes (results in an hour) which we expect to see in the US in the months ahead. Questions abound over vaccine take-up while the failure to bring Covid 19 under control naturally leads to deep skepticism over a vaccine rollout. It’s important to also consider the rollout process going better than expected led by the private sector with months to prepare the distribution logistics.

The key investment point remains better Covid control through science is imminent. What was once months away is now in some cases weeks away. A vaccine is likely to upend many portfolios, stimulate the Rotation Trade and usher in a bear market for long duration debt.

ECONOMICS

Robust US and Chinese consumption are important components of our 2021 global synchronized economic boom thesis, supported by record global liquidity, continued fiscal & monetary support and the introduction of Covid 19 vaccines. The twin engines of fiscal and monetary support remain critical even if the fiscal engine sputters a bit because it requires political agreement and coordination, things often in short supply. The DC fiscal follies for example have provided front page fodder for weeks on end now.

The key point is that come post-Election day there will be a move to provide further fiscal support in the US – regardless of who wins the Presidency and the Senate. If it is a Blue Wave then one can expect a Biden Admin to present two sizable fiscal packages in its first two years, first to provide Covid relief to citizens as well as municipalities (think House approved $2.2T bill) followed by a likely infrastructure/climate package designed to boost jobs. If it is a Biden Presidency and a Republican Senate then expect a very modest fiscal package (the $500B package floated by Sen McConnell). If it’s a Trump reelection and a Rep Senate expect a slightly larger stimulus.

The Biden economic plan seems coherent and pro-growth with both Moody’s and GS suggesting it will boost GDP by close to 4% more than the Trump plan. The outlook for a Trump 2nd term is less clear given the paucity of the Republican Party platform and the limited focus on the campaign trail as to what economic policy in a 2nd term will look like. The Fed has been clear on its role but has fewer and fewer bullets to fire… the state of the US economy in the coming years will be decided by fiscal efforts not monetary. Just one of the many regime shifts we expect in the coming years.

At the EU level, Europe is struggling to get its Joint Recovery Fund (JRF) off the ground as well as finalize its multi-year budget. At the individual country level, 2021 fiscal stimulus may be below 2020 levels, suggesting that peak fiscal stimulus may have already passed in Europe, which is somewhat worrisome, especially as the growing cases counts and lockdowns of various natures cap the consumer recovery that was manifesting itself. The ECB is likely to do more but the emphasis needs to be on the fiscal side. The risk is that countries lower their guard, expecting a vaccine inspired recovery to obviate the need for significant fiscal support.

Asia continues to move ahead, led by China where Q3 data suggest an ongoing recovery; it’s the only major economy likely to expand in 2020. China’s policy mix, centered around its dual circulation strategy (DCS) designed to encourage domestic demand, coupled with a growing desire to expand self-reliance & create its own tech stack seems well thought out. We will learn more in the upcoming 5 year plan. China’s interest rate structure remains well above the other large economies with its 10 yr. Govt bond yielding over 3%, leading to sustained foreign capital inflows & a stronger currency. FX strength encourages imports and consumption, provides an umbrella for the rest of Asia to compete & sends an inflationary impulse to the rest of the world.

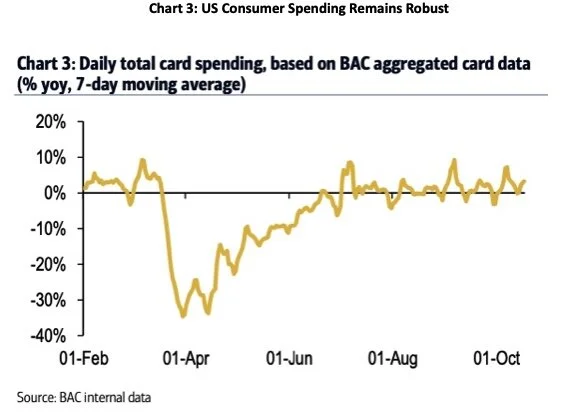

As we have noted the policy shifts from wealth concentration to wealth distribution, from fighting inflation to seeking inflation, from capital to labor and from monetary to fiscal are all global in nature. The national focus is increasingly around boosting growth and stimulating consumption via fiscal stimulus at a time of record low interest rates and a troubled global trade backdrop. The fuel is there: US FICO scores are at record highs while household net worth hit a record in Q2; in Europe, savings rates are likewise in record territory. The question is what happens next on fiscal stimulus and a vaccine. That’s what makes the next few quarters so tricky – a vaccine could bring all that spending capacity out into the open – failure to produce a vaccine will require much more Govt support. Spending and real time mobility data suggest continued economic activity with the latest BofA US credit card spending report for example showing spending up 3% y/y thru last week. ( See Chart Three)

Inflation concerns which were bubbling a bit in the US over the summer have pulled back as the reopening process slows. Euro strength has caused European inflation expectations to fall considerably resulting in some serious ECB jawboning of the Euro back under 1.20. China’s RMB strength provides some reflation space for Asia. We continue to think there is the possibility of some near-term inflation concern once a vaccine is introduced as supply demand imbalances percolate while the medium term picture will be driven by how long it takes to close the output gap across the three regions.

POLITICS

The US Presidential election remains the principal global political risk event; notwithstanding the wide polling lead held by former VP Biden, the 2016 Trump magic keeps many from accepting the reality of the President’s poor position. As we noted months ago, voters are looking for a safe pair of hands after the Covid debacle. The broad Republican effort to install a new Supreme Court Justice instead of focusing on another aid package has failed to move the needle.

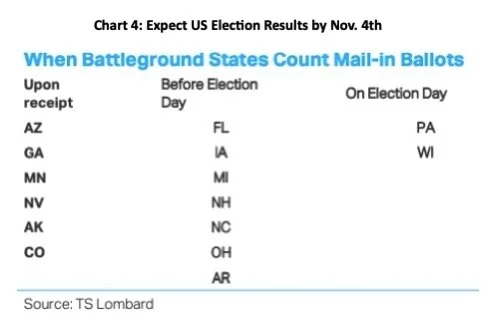

Early voting is very much underway with an astounding 37 M Americans having voted as of late Tuesday night, an amount equal to roughly 27% of the total 2016 vote. Record turnout is a given; we remain of the view that a Democratic sweep is most likely and that the Presidential election result is likely to be known by Nov. 4th if not the night of the 3rd. Florida remains a key state to watch given how tough a path Trump would have should he lose Florida. Florida, together with most battleground states, (minus Wisconsin & Pennsylvania) allows for vote processing before election day suggesting its results should be known the night of Nov 3rd. ( See Chart Four)

Perhaps more important than the presidential election is the outcome of the various Senate races given the very real prospect for gridlock should the Presidency and Senate be held by different parties. The authoritative Cook Political Report last week declared Democrats to be “the clear favorites to flip control of the Senate”.

Of course, a contested election remains a possibility and both parties have lawyered up to a considerable degree. Much depends on how close the various races are. Early turnout suggests clarity on behalf of the voters who don’t have a third party candidate to split the vote as in 2016. President Trump’s constant complaints about fraud and “rigged elections” may also have struck a chord in those who wish to vote him out of office; early voting is resoundingly in favor of the Democrats. The Republicans on the other hand have noted their wide lead in registering new voters as something that gives them hope. The Biden campaign has a clear edge in fundraising, having roughly 2.5x the money the Trump campaign has to spend as we end October. The breadth and length of Joe Biden’s coattails might make all the difference between four years of gridlock that the US can ill afford or a moderate Biden who governs as a transformational president with both chambers under Democratic control.

The polls suggest its Biden's race to lose with good odds of a Democratic sweep of the White House, Senate and House. A smashing Biden win would obviate the angst around the prospects for a contested outcome and likely clear the air for further risk asset appreciation.

Anything other than a big win, for either Biden or Trump, suggests a disputed election & weaker US risk asset prices, especially as the President continues to rail that the only way he can lose is if the vote is rigged. There is also Brexit to consider; the odds favor some sort of a deal by YE. UK has much more to lose than the EU.

POLICY

It’s fair to say that health policy in the form of vaccine approval and distribution is the most important policy point going forward, followed by fiscal policy, with even the IMF noting that austerity is so 1990s. There is little question about monetary policy as both the Fed and ECB are likely to practice asymmetric Inflation targeting (AIT) keeping rates very low at the short end and allowing the long end to steepen. Fiscal policy requires political collaboration, something in quite short supply in the US though Joe Biden believes there are a handful of Republican Senators he can work with. The economic boom we foresee in 2021 does require both fiscal and monetary policy together with a vaccine to take effect.

The bare bones Republican Party convention platform suggests a Trump 2nd term will likely be more of the same, especially on the regulatory & trade front if not the tax cut front. The Biden policy mix is much more fleshed out; depending on the path of pre-election stimulus, the first action from a Biden admin will likely be a Covid relief package followed by a large infrastructure – climate program designed to update much of the dilapidated US physical infrastructure, put people to work and expand the economy. Tax hikes on the wealthy and corporations will be used to help pay for these programs. Regulatory pressures under a Blue Wave scenario would be likely for Tech in particular but also energy and healthcare. (See Chart Five)

The potential for a Biden presidency to be transformative is quite significant, reflecting the stagnation of the past decade or so and the impetus of Covid 19 in pushing so many things forward: health care, employment, housing, inequality, racial injustice, climate etc. etc. Biden is a moderate to his bones but he also will fight tooth and nail not to be seen as a caretaker President. This coupled with his understanding and knowledge of how Washington & the Senate work could create the dynamic for a much more robust US policy response in the coming years than many imagine.

Covid 19, climate change and the US - China rivalry are all accelerating the Tri Polar World (TPW). The shift in trade from global to regional and the need for smaller countries to move closer to the center in each region further reinforces the Tri Polar World. In this TPW, the US is at risk to going from 1st to 3rd and while it is World Series time, we are not talking baseball but rather the world order. Asia, led by China is the growth and consumption pole while Europe is the tech and climate regulatory pole, the US, formerly the global leader in almost every area, now sits in 3rd place wondering what its role is to be. An active Biden Admin would be quite bullish for integration in the Americas while US gridlock in the coming years would lead to the Americas falling further and further behind Europe and Asia.

In Europe, we see the reality of joint debt issuance leading to the potential for joint taxation across the digital and climate spaces allowing one to imagine a powerful European renaissance in the years ahead. The demand for the inaugural issue was off the charts suggesting the real hunger that exists for a European safe asset to replace German Bunds, almost perennially in short supply. The multi-year nature of Europe’s main programs suggest (pending ratification) that Europe’s medium-term policy path is set. Now it’s all about execution and implementation and here there is some early cause for concern. Europe, which seemed like it was making real headway a few months back with its announcements of a Green New Deal, JRF etc. has been bogged down in the subsequent bargaining process between and among the different countries. For Europe to own the 2020s will require policy execution.

We wrote at some length last month on China’s DCS (As The Tri Polar World Turns) and suffice to say the policy mix of increased self-reliance and stimulating domestic demand seems well underway. DCS improves China’s potential to drive Asian integration in a Tri Polar World as Asian imports to China should grow while Chinese capital expands throughout the region. RMB strength helps cement these trends.

We continue to wonder why the US is so adamant at forcing China to become self-reliant - American companies are likely to be disadvantaged in one of the world’s largest and fastest growing consumer markets. It will be interesting to observe whether a Biden presidency shifts this approach. China’s UN announcement that it will be carbon neutral by 2030 and carbon negative by 2060 continues to resonate – the US absence in the climate discussion suggests climate as one of the biggest areas for a Biden presidency to make a policy difference.

MARKETS

Clarity across the big three issues: US stimulus, elections and vaccines will go a long way to eliminate uncertainty, bring money off the sidelines, catalyze the Rotation Trade, both sectorally and geographically & capsize the bull market in long duration Sov debt. Clarity will reinforce the likelihood of global economic boom and may also end the decade long period of US financial asset outperformance, something that not even Covid 19 by itself has been able to do.

Lacking this clarity risk asset markets have chopped around but as the months prior to clarity have shrunk to weeks and even days investors are starting to take positions. The breakdown of long dated UST (TLT) and the breakout, after several failed attempts, of US financials (XLF) are just two examples. Dr. Copper is breaking out, US small caps have been outperforming while big Tech acts quite heavy, now facing regulatory scrutiny regardless who wins in November. Tech remains exposed to a vaccine/stimulus package that sends rates higher, ends the work from home fad and reduces the valuation case such as it is.

We expect new all-time equity highs in the coming months & continue to believe that Tech alone can’t do it. The Rotation trade is needed to broaden out the advance and sustain it. The essence of the Growth/Value trade is Tech/Financials and we view rising rates as the fulcrum for the Rotation Trade, spurring on Cyclicals/Value while simultaneously harming Tech. A vaccine & rising rates are kryptonite for tech; we expect the rapid testing /vaccine to stimulate economic activity & lead to rising rates, especially at the long end which now has to bear all the inflation and supply related risk given a pegged short end.

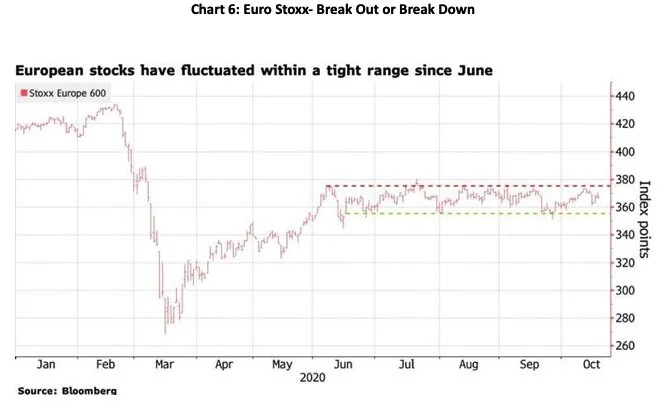

An environment where US equity does ok on an absolute basis is the best for ROW outperformance. We remain overweight equity in a multi asset portfolio, overweight non US DM vs US and EM, prefer China and East Asia tech chains within EM and Cyclical and Value together with small caps in terms of styles/factors. Financials are especially favored (Bloomberg TV Screaming Buy). Non-US DM provides inexpensive and under owned Cyclical/Value exposure. (See Chart Six)

Fixed Income is at an inflection point; one we expect to herald the beginning of a long duration Sov bond bear market. A taper tantrum in long dated Sovereigns seems quite feasible, especially given all the supply that is coming from state, sovereign & quasi sovereign issuers in 2021. Banks have been huge buyers of UST; should the economy recover and banks open the lending window who will replace them as giant UST buyers? The charts (TLT, AGG) look like they are rolling over; a 10 yr UST at 1.25 - 1.5% in the coming six months doesn't seem like a stretch, likewise a 10 year BUND yield above zero. We disagree with those who argue the Fed will not allow long rates to back up, especially in the first blush of vaccine related recovery given that such yield curve steepening will support the banks who in turn will support the recovery with more credit.

Thus we remain quite underweight Sovereigns with exception of EM $ debt, prefer Credit and within credit HY, continue to hold TIPs & Preferred and have added some real estate exposure. Covid has extended the credit cycle – IG is at risk to rate back up given the duration extension of the latest refinancing wave. The shift in inflation regimes is likely to have real ramifications for pension funds, risk parity strategies and 60-40 portfolios. 2020 has been quite good for 60-40 portfolios so far; enjoy while it lasts. Fixed income investors are going have to be much more nimble now that the bull market in bonds is over while multi asset investors used to using Govt bonds as equity hedges will have to think outside the box.

While the USD and Euro get the bulk of attention in FX land the rise of the RMB might well be the story of the year, both this one and 2021. A gradually strengthening RMB has all sorts if implications for the rest of Asia, for a Europe selling into Asia and for the US which has spent the last several years arguing against an (expanding) trade deficit with China. China needs foreign capital to offset the end of its current account surpluses, now down to almost nothing. Importing foreign capital to help drive self-reliance and domestic demand makes sense. From a Tri Polar World POV it could mark the beginnings of regional currency blocs: RMB led in Asia, the Euro in Europe and the USD in the Americas. We expect further USD weakness in a Biden Admin given rising twin deficits and growing interest in non US assets.

Commodities remain very much of interest with breakouts happening in the industrial metals space as noted above. Covid killed the experience based lifestyle and rebooted the buy stuff one – good for commodities. China’s economic recovery is another driving factor & USD weakness another while several years of reduced cap ex suggests supply could also become an issue. Negative real rates across the advanced economies suggest precious metals should also remain favored though the offset of higher nominal rates could be a limiting factor. We remain clean energy believers but are toggling back to the oil patch given growing signs of M&A activity coupled with our 2021 economic outlook. This is an area worth exploring across assets from MLPs to equity to HY.