As The Tri Polar World Turns - October 2019

MACRO THEMES

As we enter Q4 the pace of action seems to be picking up. While many key issues are long standing: US - China trade, global manufacturing slowdown, Brexit, some, such as the HK protests and US impeachment, are more recent. Financial markets are range bound, waiting for catalysts on some of these fronts. We have had some feints, like the recent Growth/Momentum factor implosion, that gives one a sense of what could happen with a catalyst & clarity. We think the odds are pretty good that we will see positive catalysts during the quarter, perhaps in trade, perhaps in a bottoming of the global manufacturing slowdown and expect that movement to have asset price implications. We remain positive on risk assets and have added to the Cyclical nature of our portfolios.

As was the case in August, the financial markets chopped a lot of wood in September: from the Growth/Momo factor crash to the attack on Saudi oil facilities and consequent oil spike (totally retraced), to Repo madness, the We PE implosion (a sign of public market sanity) and on to the opening of a formal impeachment inquiry into Pres. Trump. Given that all this occurred during the worst seasonal period of the year one has to conclude that cross asset markets have been Teflon like.

A Lower for Longer Global Growth Path remains our central theme. Within that, we continue to monitor our Big Four signposts: the Global Easing Cycle: in full bloom; the US - China Trade fight: odds rising for a 2019 skinny deal; a Global growth bottom: ahead as Global Manuf PMIs bottom & turn up while EPS revisions seem to be stabilizing.

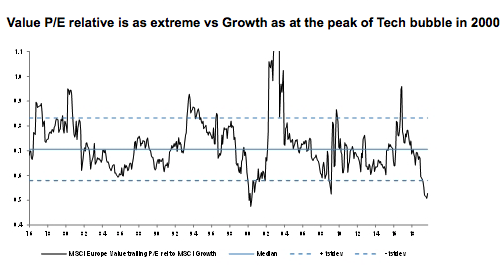

As we enter Q4, we continue to look for a Fall Risk Asset Rally. We don't share the concern that Q4 19 will be a repeat of Q4 18 given Central Banks are easing instead of tightening, there is a better trade tone and investor sentiment is very muted. Investors are looking for guidance & catalysts: Q3 earnings & the 2020 outlook will provide important guidance; a skinny trade deal or signs of stability in the global economy could serve as catalysts. Low expectations across the board suggest a bullish set up (See Chart 1).

Chart 1: Epic Growth Skepticism Visible in Growth/Value

Source: JPM

ECONOMICS

Goldman’s September Global Current Activity Indicator (CAI) came in at 2.6%, in line with summer levels & pointing to global growth of roughly 3%. Growth at this level should be sufficient to maintain a flat unemployment rate (UER) and right on schedule, the OECD reports a record low UER of 5.1%. In turn, record low unemployment and rising wages have led the Conference Board’s Global Consumer Confidence Index to an all-time high in Q3, suggesting continued robust household spending over the coming six months. No recession here.

The US seems to be growing at roughly trend growth of 2% or so (forecast Q3) as GS notes current recession fears seem “overblown”. China’s L shaped economy appears to be stabilizing around 6% GDP growth as its Composite PMI has risen for the past three months in a row. Japan’s growth of around 1% has been better than expected while various EMs are both cutting rates and adding fiscal stimulus to the mix (India, Indonesia etc.) to boost growth. Europe remains the weak sister with recent data being pretty disappointing.

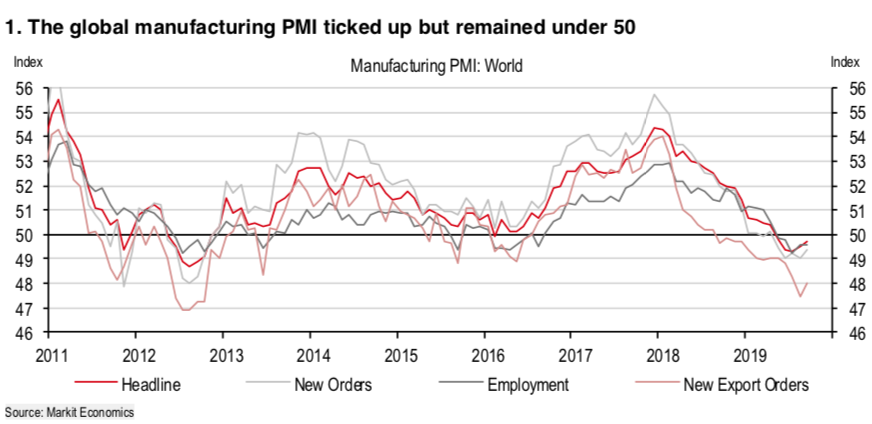

We continue to focus on the Service and Composite PMIs rather than a narrow focus on the Manufacturing PMI given that the advanced economies are 75-80% service. The open question remains whether weak manufacturing will bleed into the service sector, especially given the US ISM breaking south and weak European data on both the service and production sides.

We think not and note that the Global Manufacturing PMI has bottomed and is turning up as Chart 2 illustrates. More specific PMI data on autos and semiconductors, two important manufacturing sectors that have been very weak, also point to upturns. We continue to see weak US ISM data as a “catch down” to the ROW - a catch down that is likely to mark the bottom of the global cycle rather than the beginning.

Chart 2: Global Manufacturing PMI Bottoming

Source: HSBC

POLITICS

When Boris Johnson and Donald Trump sat together at the UN it was like two deer caught in the headlights - Trump was aware of the brewing storm over his Ukraine phone call while Boris was under pressure not only on Brexit but also regarding rumors of affairs and providing public contracts to his mistress. Several weeks later and impeachment is virtually a done deal as Brexit continues to thrash about. While impeachment ensures continued US political dysfunction, it also seems to have brought the 2020 election into focus with growing talk of an Elizabeth Warren presidency and even a possible Democratic sweep. While Warren does seem likely to be the Democratic Party candidate the rest seems way too early to discuss.

Brexit may play out a bit better with Goldman and others suggesting odds of a crash out are falling & now down to 15%. The more likely scenario is an EU extension followed by a late year UK election… thus kicking Brexit into 2020 when presumably a somewhat stronger EU economy will be better placed to handle any fallout.

China has celebrated the PRC’s 70th anniversary and while Pres. Xi is challenged by Trump and Hong Kong protests he also seems to be in the catbird seat with very little opposition. Hong Kong is worrisome as violence seems to be becoming more of a regular protest feature. While much of the underlying concern revolves around economic opportunity for the students, its continuation will start to chip away at the economic value of Hong Kong as a safe, stable place to do business. Whether Pres. Xi decides to help Trump out with a trade deal while perhaps helping himself (China almost certainly would prefer a Trump reelection to a Democratic alliance builder as Pres.) time will tell. Xi’s restraint on both trade/stimulus and HK seems like that of a confident guy.

Positive outcomes on both US – China trade & Brexit would lift a lot of geo economic and geo political uncertainty and would catalyze risk asset upside.

POLICY

Full throated global easing remains on course with the Fed likely to cut again before YE while the ECB has cut rates and restarted QE while pleading for fiscal support. Weak US ISM data is calling into question the idea of a Fed “insurance policy” rate cutting process vs a full scale easing cycle. Either way, the Fed is having some success steepening the yield curve, one of its main objectives.

The BOJ is seeking ways to steepen its yield curve, suggesting its month end meeting will be important. Japan’s VAT hike to 10% has gone into effect; while time will tell there is a sense that it will prove much less debilitating that prior hikes. The PBOC remains discreet as does the entire Chinese economic policy apparatus, easing slowly and in a targeted fashion. Declining inflation in both Asia and Latin America sets the stage for further rate cuts in both regions.

Fiscal policy continues to gain traction around the globe as it becomes self-evident that neither China nor the US consumer will bail out the global economy. This is especially true in Europe with Holland, Italy and France all boosting spending while Draghi calls for a fiscal union, a call his successor, Ms. Lagarde, is likely to take up.

Germany remains the odd woman out with Merkel not willing to move aggressively even though there seems to be plenty of room to ease fiscal policy w/o breaking “black zero”. A possible German recession in Q2-3 might change that equation - the structural needs are there & both bankers and businessmen alike are asking for help but the political will has been lacking. Opportunity exists: Italy recently borrowed 10 yr money at 0.88% vs a 10 yr yield of well over 3% last Nov.

Recent OECD research suggests that the most potent policy is a mix of both monetary and fiscal policy which not only provides more support to GDP growth but also tends to be less likely to stoke asset bubbles. EMs such as Indonesia, India and others seem to have read the report, deploying both fiscal and monetary instruments as more countries recognize the need to take growth matters into their own hands under the umbrella of an easing Fed. In our own Global Risk Nexus (GRN) work we have noted that the two main areas of improvement vs a year ago are Economic Outlook (6-12 months forward) and Policy (growing use of both fiscal and monetary).

Q4 is also crunch time for US - China trade policy. While there is a lot happening around the trade talks the timing for a deal in 2019 requires significant progress this week, followed by an early November meeting in China and culminating in a signing ceremony at the APEC Summit in mid-November. As discussed previously a 2019 deal will allow for C suites to plan 2020 budgets and cap ex with some certainty thus reducing recession risk and bolstering Pres. Trump's chances for reelection (See Chart 3). China will benefit from ag purchases to help offset rapidly rising pork prices which threaten social stability, thus providing two sided impetus for a skinny deal built around agriculture.

Chart 3: A Skinny Trade Deal could Boost CEO Confidence

Source: WSJ

MARKETS

The list of positives for risk assets entering Q4 is a pretty long one: financial markets chopped a lot of wood over the past two months, seasonality is improving, positioning is very light & sentiment is deeply negative while relative equity valuation versus bonds is quite attractive, earning revisions appear to be bottoming & 2020 EPS forecasted growth of 10% held up well over Q3.

On the macro support side one has a potential bottoming in the global economy while Central Banks ease, liquidity flows (up in Japan, Europe) & fiscal policy boosts spending, leading to easy financial conditions & what sounds like a good environment for risk taking. While the S&P is up roughly 20% and ACWI up around 16% YTD - over the past one (and two) year it's a different and much tamer return story.

Offsetting this good news is the fear that Q4 19 will be a replay of Q4 18, with fear being driven by very high policy uncertainty, impeachment worries, and trade & growth concerns. Some of the main differences between late last year and now is that CBs are easing vs tightening while positioning is much lighter and rates are much lower.

In addition, there is a lot of concern around the Growth/Momo factor crash & whether markets are truly at a turn from Growth towards Value and from the US to ex US equity. For Value to work economic growth needs to bottom and should that transpire interest rates will back up. It's worth recalling that 10 year UST fair value is 2% vs around 1.65% currently. Forward return forecasts support a shift to non US equity markets but clients recall what has worked and that is US equity.

Perhaps some of the most interesting work of late has been done by JPM showing how asset returns differ in PMI cycles (See Chart 4). The falling phase offers the poorest return profile while returns are 4-5x higher once PMIs start to turn up as they have begun to do. That is the turn we are looking for. Soc Gen points out that both Cyclical stocks and global bonds have priced in a recession - if one doesn't materialize the reversal will be significant.

Chart 4: A lot to Play for in Global Manuf PMI Upturn

Source: JPM

Q3 earnings season is imminent - watch US 2020 estimates which fell just slightly from 11% at 6/30 to 10% today. In other words throughout the last three months of economic angst equity analysts have kept their 2020 #s intact. Will that remain the case? It's also worth watching the Tech sector; Factset notes that a record number of tech companies, led by the software segment, gave negative Q3 pre guidance.

Outside the US, JPM just upgraded European equity to OW with a focus on financials that have yet to price in the benefits of peripheral bond spread tightening vs Germany. Japan was the stealth equity leader in September and would benefit from a better risk tone & weaker Yen (stocks already pricing in 100 vs current 108). In addition, Japan continues to sell at a major (30%) discount to ACWI. Among our preferred EM, Brazil’s pension reform is slowly making headway as the economy picks up while China deals with Trump & trade. Interestingly enough, HSBC’s work shows both countries have had the most robust upward revisions to 2019 EPS over the past three months.

In Fixed Income, the duration bulls took a slight rest this past month while credit remains robust as companies issue to extend and refi their existing obligations. UST and Bunds are at risk to positive catalysts on either trade or the economy. EM $ debt continues to offer real value vs its history. TIPS may be worth a look; if growth bottoms the next step will be to extrapolate an inflation pick up. As Chart 5 suggests inflation expectations are quite low.

Chart 5: Inflation Left for Dead

Source: JPM

The USD has remained stronger than expected and the Euro has broken under 1.10; dramatic Euro weakness from current levels seems unlikely but so does a major rebound. EM Fx remains somewhat weak as rates are cut to offset RMB decline and stimulate growth. RMB forecasts for YE are between 7.20-7.50 vs current level around 7.15. Should a trade deal be reached the RMB is likely to strengthen rather than weaken, providing more support for China equity performance.

In the Alts space Commodities have been weak with oil fully reversing its mid-month pop suggesting the market remains very skeptical of the demand side. Given Middle East volatility the lack of risk premium in oil seems odd. Ag has bounced on weather and China purchase hopes while precious metals fall on good news and rise on bad. Goldman has pushed out its copper rally forecast into 1H 2020 on the base metals side of things.

PORTFOLIO STRATEGY AND ASSET ALLOCATION (GMMA)

We made limited changes to our portfolios this month with our main objective being to add cyclical exposure & better position the portfolios for a growth bottom. We remain overweight equities, underweight bonds, alternatives & cash.

We remain overweight the non US equity markets with a focus on Europe and Japan given our belief that those markets offer greater room for appreciation based on ownership, valuation and currency upside. Should the shift to Value take hold both will benefit.

Our EM equity exposure remains focused on China and Latin America; earnings growth, positive policy momentum in China & Brazil together with room for rate cuts in Mexico support those positions. A trade deal would propel China assets higher.

On a Factor basis, we maintained our US & Global Min Vol positions & our US Value position.

In Fixed Income we added a US TIPs position to prepare for rising inflation.

We expect USD weakness based on Fed rate action, Presidential jawboning, massive twin deficits and a clear bottom in non US economic growth. The Euro screens very cheap relative to its history.

We made no changes in the alternative space & maintain a position in Silver. We continue to favor energy via our MLP position.

GLOBAL MACRO SUITE PORTFOLIO CHANGES

Global Macro Multi Asset (GMMA)

Within equities, we exited our Tech software position and replaced it with a Semiconductor position.

Global Macro Income (GMI)

We reduced our UST belly position to fund a TIPs position.

Global Macro Equity (GME)

As in our GMMA equity sleeve we reduced our US Tech software position to fund a Semiconductor position.

In Asia we reduced our Asia X Japan position to fund a position in Taiwan as a play on the global tech cycle as well as a way to benefit from the US - China trade fight.

I hope you find this monthly piece of value and look forward to engaging with you on a monthly basis as we round out 2019.

Jay Pelosky, CIO & Co-Founder

TPW Investment Management

DISCLOSURE:

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts are inherently limited and should not be relied upon as an indicator of future results. There is no guarantee that these investment strategies will work under all market conditions, and each advisor should evaluate their ability to invest client funds for the long-term, especially during periods of downturn in the market. Some products/services may not be offered at certain broker/dealer firms.

There can be no assurance that the purchase of the securities in this portfolio will be profitable, either individually or in the aggregate, or that such purchases will be more profitable than alternative investments. Investment in any TPWIM Portfolios, or any other investment or investment strategy involves risk, including the loss of principal; and there is no guarantee that investment in TPWIM’s Portfolios, or any other investment strategy will be profitable for a client’s or prospective client’s portfolio. Investments in TPWIM’s Portfolios, or any other investment or investment strategy, are not deposits of a bank, savings and loan or credit union; are not issued by, guaranteed by, or obligations of a bank, savings and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency.

The investment descriptions and other information contained in this are based on data calculated by TPW Investment Management, LLC (TPWIM) and other sources including Bloomberg. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. This report should be read in conjunction with TPWIM’s Form ADV Part 2A and Client Service Agreement, all of which should be requested and carefully reviewed prior to investing.