As The (Tri Polar) World Turns - October 2018

MACRO THEMES

The main macro theme this month is the growing sense that while headlines scream America First the shift from US Divergence (leadership) to Rest of the World (ROW) Convergence is underway. This is shaping up to be the main story of 2019.

From an Economics perspective there is a growing sense that global growth will be able to cope with trade & tariff fears as the US narrows its trade ire to China and China responds by providing fiscal & monetary support to its economy. 2019 forecasts suggest US growth will slow much more than China’s for example. China is probably best placed to confront trade friction given the multiple levers it can pull to offset the negative tariff effects. From a Tri Polar World (TPW) point of view deeper pan Asian integration is a likely outcome of US – China trade conflict as production moves from China to SE Asia thereby deepening physical and financial connections between China and the rest of Asia.

On the Political front, Italy continues to bedevil European financial markets, as its recent budget announcement reversed what was beginning to look like an incipient European equity rally. As Chart 1 shows, Italy has a large amount of debt to roll over in the coming quarters and year; we continue to think the new Govt is unlikely to want to completely upset the apple cart. Market action across EU assets looks more like a retest of recent lows than a breakdown. Across the Atlantic, US political risk would seem to be rising as mid-terms approach and the prospects for a Democratic sweep of the House and Senate grow.

Chart 1: Italy’s Debt Maturity Wall

Source: WSJ, Scotiabank Economics, Bloomberg

Policy wise the main issue remains the pace of Central Bank activity. The Fed has raised rates for the 8th time in this cycle & removed its accommodative language suggesting that rates are approaching neutral and future hikes will represent tightening. This raises the question of whether the Fed will move to invert the yield curve by itself or does it expect stronger growth/inflation to pull up the back end of the curve? The risk of a Fed policy mistake would seem to be growing as the Q4 2019 US GDP growth consensus calls for only 2% growth. In Europe, ECB head Draghi recently noted that underlying inflation was “vigorous” suggesting that the ECB is on track to end QE and raise rates over the next several quarters as well, thereby narrowing the policy divergence between the Fed and the ECB.

In Markets, it is worth noting that some of the non-US markets (Brazil, Turkey) seem to be finding a floor across the FX, bond and equity space, perhaps calling into question continued USD strength. In addition, Japan’s equity market has just hit a 27 year high & may be breaking out. Valuation is supportive and is reinforced by what we have termed the “quiet riot” taking place in Japanese corporate profitability shown in Chart 2. Recent Japanese economic data has been solid while it’s Political & Policy stability is enviable. Investors remain quite underweight both Japan & Europe.

Chart 2: Japan’s Quiet Riot

Source: WSJ, Japan Ministry of Finance

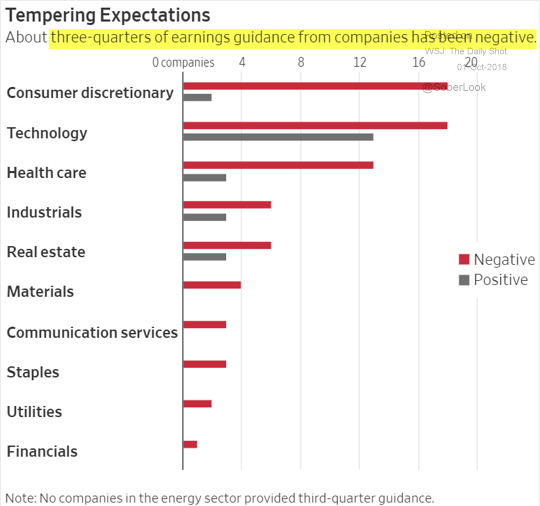

Earnings season is upon us as is the fourth quarter of the year. 2018 US earnings growth, turbocharged by tax cuts and share buybacks, has been much stronger than the rest of the world, underpinning US equity market outperformance. As Chart 3 (next page) shows however, that earnings support may be ebbing. Tech earnings for example are forecast to be less than the market average in Q3 and only equal to the S&P average in 2019, calling into question tech leadership & the momentum trade. More broadly, 2019 US earnings are forecast to converge with European earnings growth rates (roughly 10%). Thus, US - EU earnings convergence coupled with valuation divergence, i.e, the US is relatively expensive, would seem to call into question continued US equity leadership.

Chart 2: Sharp Rise in US Negative Guidance

Source: WSJ, Factset

As we enter Q4 seasonality improves for equities, not just in the US but in the rest of the world as well. We continue to look for convergence in equity market performance as we enter Fall and look into 2019.

PORTFOLIO STRATEGY AND ASSET ALLOCATION

Given our positive global growth outlook we continue to favor global equities over bonds and maintain positions in alternatives.

Within fixed income our bias remains in favor of US credit versus sovereign exposure. We continue to favor USD EM debt, an asset that correlates strongly with UST but provides a significant yield pickup. Our expectation for better EU growth leaves us with minimal exposure to non-US sovereign debt positions.

We made no changes to our regional equity allocations though we did reduce the beta of our Americas equity allocation.

Europe remains our favored regional equity allocation & we remain exposed to core European equity as well as small caps and financials.

Within alternatives we shifted our exposure to reflect the prospects for a more diversified commodity rally supported by China reflation efforts while maintaining our MLP position.

Plenty of risks remain but many are no longer new. Investor response to Italy will be a good indication of how much has been discounted; our sense is that much non US risk is discounted – in the US not so much.

GLOBAL MACRO SUITE PORTFOLIO CHANGES

Global Macro Multi Asset (GMMA)

We exited our US Tech equity position and added to our US Defensive equity exposure through a dividend focused vehicle.

We added to our USD EM Debt position and believe it will continue to benefit from EM finding its footing & the search for yield.

On the sovereign debt side we further reduced our long duration UST position and eliminated our MBS exposure believing that better opportunity exists in the US IG space where we opened a position.

Within Alternatives we exited our gold position in favor of broad commodity exposure.

Global Macro Income (GMI)

In the sovereign space we reduced our long dated UST position & exited our MBS position while adding to our USD EM debt position.

Within the corporate credit space we added to US HY credit.

Furthering our multi asset approach to the GMI portfolio we initiated a position in an equity dividend vehicle to go alongside our existing gold & MLP positions.

Global Macro Equity (GME)

In keeping with our approach to portfolio consistency we exited the US Tech position and added to our US Defensive exposure via a dividend focused ETF.

Outside the Americas, we took advantage of Italian budget fears to add to our European Financials position by reducing our broad European exposure.

We hope you find this new piece of value and look forward to engaging with you on a monthly and quarterly basis.

Jay Pelosky, CIO & Co-Founder

TPW Investment Management

DISCLOSURE:

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts are inherently limited and should not be relied upon as an indicator of future results. There is no guarantee that these investment strategies will work under all market conditions, and each advisor should evaluate their ability to invest client funds for the long-term, especially during periods of downturn in the market. Some products/services may not be offered at certain broker/dealer firms.

There can be no assurance that the purchase of the securities in this portfolio will be profitable, either individually or in the aggregate, or that such purchases will be more profitable than alternative investments. Investment in any TPWIM Portfolios, or any other investment or investment strategy involves risk, including the loss of principal; and there is no guarantee that investment in TPWIM’s Portfolios, or any other investment strategy will be profitable for a client’s or prospective client’s portfolio. Investments in TPWIM’s Portfolios, or any other investment or investment strategy, are not deposits of a bank, savings and loan or credit union; are not issued by, guaranteed by, or obligations of a bank, savings and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency.

The investment descriptions and other information contained in this are based on data calculated by TPW Investment Management, LLC (TPWIM) and other sources including Bloomberg. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. This report should be read in conjunction with TPWIM’s Form ADV Part 2A and Client Service Agreement, all of which should be requested and carefully reviewed prior to investing.