As The Tri Polar World Turns - March 2019

MACRO THEMES

Where to from here? That's the operative question given the strong start to the year with virtually all assets up. One could argue assets are extended based on multiple data points including RSI and yet evidence points to very light positioning, indicated by hedge funds net levels, mutual fund cash levels and manager surveys. Recent data points including China growth forecasts, OECD growth cuts, and ECB forecast changes have called into question the steps we have been looking for to support the risk asset move (China trade deal, European growth bottom, China growth bottom). This poor data could set the stage for a welcome pullback, perhaps the pause that refreshes. Major downside risk seems limited as the growth cycle outside the US starts to turn and previously mentioned high cash levels look to be put back to work on weakness.

ECONOMICS: The gentle deceleration towards potential growth rates in the DM economies continues apace. Recent weeks have displayed not only budding signs of Spring but of stabilization in both Europe and China. Confirmation of growth bottoms in both areas are critical to support the global economy & risk asset pricing. The US continues to “catch down” to the rest of the world with Q4 GDP growth of roughly 2.5% while Q1 2019 tracks at about 1.0%, numbers that are likely to keep the Fed on hold for the foreseeable future.

TPWIM remains focused on consumer demand as the key economic indicator to observe. EU retail sales continue to be robust fueled by low unemployment levels and rising wage gains. European service PMIs have stabilized or ticked up helping Composite PMIs approach stabilization. Early indications suggest the auto cycle is about to pick up after being depressed for much of 2018. Recent Industrial Production numbers ex Germany were better than expected in France, Spain and even Italy. All this combines to suggest European growth may be bottoming (see Chart 1).

Chart 1: : European Growth Bottom Upon Us?

Source: WSJ

China stimulus has been underway for roughly a year and news from the NPC meeting suggests it will continue with VAT cuts while further targeted financial easing remains likely. January’s total financing numbers grew sharply while housing prices remain up roughly 10% y/y, suggesting that the all-important housing market remains in decent shape. Rising house and stock prices should support the Chinese consumer. Demand for USD based debt issued by Asian corporations is at record levels which is good news for China property developers in particular. The manufacturing sector also appears close to stabilization as suggested in Chart 2.

Chart 2: China Stabilizing?

Source: Macrobond Financial, Bloomberg, PBOC, Danske Banks, WSJ

POLITICS: Headline risk, be it Trump, Brexit, European populists or the Mueller investigation seems all but discounted. Little is expected out of DC or London, Paris or Frankfurt for that matter. Beijing is focused on the trade deal (and playing hardball: Q4 US exports to China were down 33% y/y) while the US walkaway in Hanoi sets up a “tough Trump” to claim victory in a China trade deal. Europe’s Parliamentary elections are coming up in May and the betting is the populist fervor will turn out to be a damp squib. Brexit seems likely to be extended. While not an election the Brazilian pension reform process is underway in Congress and may be voted on in May as well - it is key to Brazil’s long term story.

POLICY: March is shaping up as an important month for Central Banks on both sides of the Atlantic. The Fed may well announce exactly how QT will end; Chart 3 suggests how important this decision will be for global liquidity. In Europe the ECB has eased its forward guidance, saying no rate hikes in 2019 & thus validating the market outlook. It also announced another round of TLTROs beginning in September to ensure the banks do not come under market pressure from the maturing of existing loans. The PBOC remains in easing mode; the case for an Emerging Market led global easing cycle is enhanced by weak inflation in much of Asia which frees up rate cuts as a policy tool.

Chart 3: QT Approaches its End Game

Source: JPM

On the US - China trade policy front, first an extension, then a deal seems like the path to success for both countries. The fear that the US could pivot from fighting with China to fighting with Europe remains a worry but a look at EU auto stocks suggests such worries are in the price. The US focus on China maintaining a stable Yuan seems like a gift to US investors; could it be that the US wants a weak dollar & so wants to lock China in first? If so, China may well sign off figuring it can weaken alongside the USD. Recent comments from Pres. Trump suggest this might indeed be the case while Chart 4 shows how the strong dollar is affecting US exports.

Chart 4: US Wants a Weak Dollar

Source: Capital Economics, WSJ

MARKETS: We have highlighted three keys for risk asset appreciation: a China trade deal, European economic bottom, and a bottom in the China growth slowdown. Anticipation of these key factors helped risk assets reverse much of Q4 lows. China in particular will benefit from a trade deal plus growth bottom combo and would seem to be in the early stages of a bull market. The Shanghai Composite has been on a tear, up every week until this past one, a pullback here is healthy. The shift from a tight Fed and slowing China to a loose Fed and a stimulating China should be good for global risk assets. Chart 5 suggests global earnings revisions are stabilizing. The question up 15-20% from Dec lows is how much is in the price? A pause to refresh would be healthy.

Chart 5: Global EPS Revisions Bottoming

Source: WSJ

Thinking through the Q4 risk asset selloff, YTD rebound and potential for a pause/pullback it seems that our three keys above could turn out to encompass Step One of a three step process for risk assets. Steps Two & Three will most likely be necessary to drive further meaningful risk asset price appreciation.

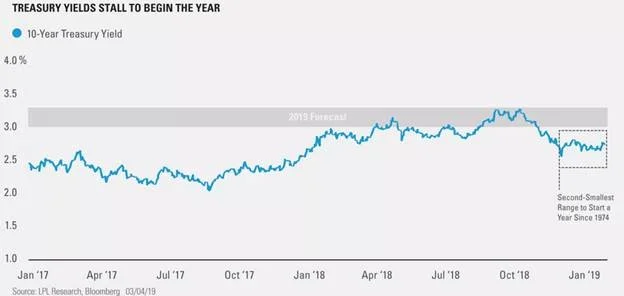

Step Two will be growth bottom confirmation by rising long rates in China, Europe, and the US. In other words, if rates continue to fall in these three regions then it is unlikely that growth will pick up any time soon. Chart 6 shows how tight the UST trading range has been to start the year.

Chart 6: UST Yields to Confirm/Deny Growth Bottoms

Source: WSJ

To date, rates have yet to confirm growth bottoms either in Europe where Bunds remain at roughly .10%, China where the 10 year yields roughly 3.20% down from a high of 3.7% last Fall, or in the US where the 10 yr UST remains caught at roughly 2.6-2.7%. Short interest is building in the longer duration part of the UST curve as some expect better economic news + expanded supply to spell UST weakness. Rising rates & steepening yield curves would be bullish for cyclical sectors, including financials, especially in Europe.

Step Three would be reallocation to non US markets and follow on USD weakness confirming the non US growth bottom & the attendant shift in investor interest from the US, the only equity game in town between 2009 - 2018, to the rest of the world. The stronger USD while the Fed pivots has been a surprise, perhaps suggesting how entrenched the view of weak non US economies really is. Alternatively the view could simply be the US growth profile, even in its slowing state, is better than the ROW. Either way, better growth outside the US would seem necessary for the USD to weaken.

Trade deals and growth bottoms coupled with a global easing cycle and weak dollar should spell good news for the commodities segment. So far, so good with oil up sharply YTD on OPEC production cuts as well as sense that demand may pick up in the 2H of the year. Dr. Copper, up 11% ytd, suggests that the global economy may be bottoming out. A Fed on hold & continued Central Bank buying should continue to support Gold but dollar weakness will lead it higher.

US Credit and EM debt have been winners and both remain attractive with JPMorgan highlighting US High Yield as having the most attractive risk reward profile of the major assets. With major CBs on hold and no inflation in sight, carry seems pretty appealing, especially given $11T in negative yielding debt. This is good for EU periphery sovereign debt as well as corporate credit & ultimately European stocks as well.

PORTFOLIO STRATEGY AND ASSET ALLOCATION

We have made limited asset class portfolio changes this month given our view that markets were extended and due to pause. We remain neutral equity, underweight bonds, overweight alternatives, and hold some minimal tactical cash.

Within equities, we continue to prefer the non US equity markets. We anticipate better European growth data to benefit our positions there, especially in the financials. A positive macro risk environment which we laid about above should benefit our preferred positions in China, Latin America, and global metals & mining. We maintain our lower risk profile in US equity.

In Fixed Income we held our positions in the US: OW credit and prefer the belly of the UST curve. We continue to hold positions in both EM USD debt as well as EM local currency as they benefit most from the Fed pause and a bottoming of EM growth. Our expectation for better EU growth led to initiating a position in European HY.

We remain overweight Alternatives with a position in broad commodity exposure and a tilt to energy via an MLPs position. We have high conviction in OPEC, specifically Saudi, desire to maintain production cuts to ensure higher oil prices. We also maintain a gold position across our portfolios and expect gold to benefit from a bottom in ex US growth.

We maintain a small cash position as we await the economic & political signals noted above to add to our preferred risk positions.

GLOBAL MACRO SUITE PORTFOLIO CHANGES

Global Macro Multi Asset (GMMA)

Within equities, we added to European Financials which should benefit from a growth bottom and BUND yield back up.

On the fixed income side we flipped our DM non-US Sovereign positions to European High Yield.

Global Macro Income (GMI)

As in the GMMA portfolio, we flipped our DM non-US Sovereign positions to European High Yield.

Global Macro Equity (GME)

We eliminated our Dutch position to fund an increase in our European financials position.

We hope you find this monthly piece of value and look forward to engaging with you on a monthly and quarterly basis as we go thru 2019.

Jay Pelosky, CIO & Co-Founder

TPW Investment Management

DISCLOSURE:

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts are inherently limited and should not be relied upon as an indicator of future results. There is no guarantee that these investment strategies will work under all market conditions, and each advisor should evaluate their ability to invest client funds for the long-term, especially during periods of downturn in the market. Some products/services may not be offered at certain broker/dealer firms.

There can be no assurance that the purchase of the securities in this portfolio will be profitable, either individually or in the aggregate, or that such purchases will be more profitable than alternative investments. Investment in any TPWIM Portfolios, or any other investment or investment strategy involves risk, including the loss of principal; and there is no guarantee that investment in TPWIM’s Portfolios, or any other investment strategy will be profitable for a client’s or prospective client’s portfolio. Investments in TPWIM’s Portfolios, or any other investment or investment strategy, are not deposits of a bank, savings and loan or credit union; are not issued by, guaranteed by, or obligations of a bank, savings and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency.

The investment descriptions and other information contained in this are based on data calculated by TPW Investment Management, LLC (TPWIM) and other sources including Bloomberg. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. This report should be read in conjunction with TPWIM’s Form ADV Part 2A and Client Service Agreement, all of which should be requested and carefully reviewed prior to investing.