As The Tri Polar World Turns - January 2019

MACRO THEMES

What a difference a few weeks make, right? As we enter a new year, global policy makers on both the fiscal and monetary front have stepped up their game, allowing investors to recalibrate the odds of a global growth/earnings recession. The Fed is clearly on hold - an appropriate stance from this armchair - while European authorities activate the fiscal policy button for the first time in too long. US - China trade talks dial down risk fears while China itself continues to use both fiscal and monetary policy to stabilize its economy. All this has been sufficient to generate a bounce in risk assets. Further upside is likely to require confirmation of policy results, both in terms of economic growth bottoming as well as earnings revisions stabilizing as fundamentals come back into vogue.

From an ECONOMICS perspective the focus needs to shift to the consumer and consumption. Central Banks are more in sync with the Fed on hold and China’s PBOC active, a positive for the global economy. Global Manufacturing PMIs downward slope remain a worry but at 51.5 remain well above the breakeven 50 level. The key question is what will keep that # above 50 and the answer is the consumer. Surprisingly, the European consumer might look best with a decade low, 7.9% unemployment rate (Chart 1), real wages expanding at the highest rate in years, low oil prices, and a rising Euro. These all support a continuation of recently rising retail sales which in turn should support production (PMI). The US consumer remains in decent shape while China’s consuming class will benefit from lower taxes & interest rates.

Chart 1: Eurozone Unemployment Rate

Source: WSJ

Resolution of the US - China trade tiff remains quite important given the angst it is causing not just in those two countries but also in Japan, Europe and much of Asia. The globe’s best growth region is (surprise) Latin America, the only region forecast to have stronger year over year growth between 2018 and 2020, led by Brazil’s cyclical recovery. A global slowdown rather than recession seems likely and the question now becomes when does growth stabilize and at what level? Signposts to watch include: rising rates in both Europe & the US and stabilizing growth #s in China.

Much of POLITICAL risk has been aired ad nauseam and thus may well have lost its capacity to shock markets. The US Govt shutdown is one example. Yet if unlikely to cause dramatic downside, the Trump factor in the US is likely to limit the upside. The upcoming Mueller report is expected to be quite damaging to the President who in turn is feverishly working to maintain his base (Build that wall), which in turn will keep him from being impeached. This suggests continued US headline risk. As noted above the US - China trade talks remain as an important political item. Both sides seem to be setting up for a Potemkin deal, a la the NAFTA redo or the NK talks, in which very little of substance will change but the US in particular will be able to declare it a success.

On the POLICY front the policy thrust differs according to region. In Asia the focus is on stabilizing China via both fiscal and monetary levers (Chart 2), elsewhere elections in India and Indonesia suggest continued spending. In Europe political pressures, particularly in Italy and France, are leading to a “better late than never” embrace of fiscal stimulus. Hopefully, this will allow the ECB to continue along its QE exit path. In the Americas, the US fiscal impulse has already been played, and so the monetary path is key; the Fed stepping back to assess its recent handiwork, particularly around liquidity, makes a lot of sense. Broad policy reform in Brazil will be critical to sustain a cyclical economic recovery.

Chart 2: China Econ Surprise Indicator Suggests More to Do

Source: Goldman Sachs Investment Research, Bloomberg, WSJ

Central banks more in sync, fiscal policy in play, stable oil prices (Saudis clearly working to boost prices), and employed consumers with growing wage packets all suggest a low growth and low inflation world which in turn, doesn't seem all that bad an investing environment. A positive side note, the “rejection of austerity” as Larry Summers called it in a recent FT editorial, if implemented, could extend the current recovery.

Thus to MARKETS. In a low growth and low inflation world it would seem to make sense to focus on areas offering growth and yield. Doing so in an environment where valuations have come in sharply, earnings estimates have been reduced, sentiment has been washed out, leverage has been cut, and the technicals are turning supportive suggests being too negative is more a risk than being (somewhat) positive on risk assets. Clarity on both an economic and earnings growth bottom is key. The upcoming Q4 Earnings season will be very important for insight into 2019 as investors discover whether Apple and FedEx warnings are systematic or idiosyncratic (Chart 3). We laid out our views in our 2019 Outlook. In essence we expect to see a leadership change in global equity markets away from the US which suffers from a US centric Trump - Tech combo. Within the non US equity space we continue to prefer a mix of DM and EM markets avoiding countries dependent on tech sector (Korea, Taiwan, etc.).

Chart 3: Global Profit Expectations Remain too High to Signal Big Low

Source: BAML Global Investment Strategy, Datastream, IBES, MSCI, WSJ

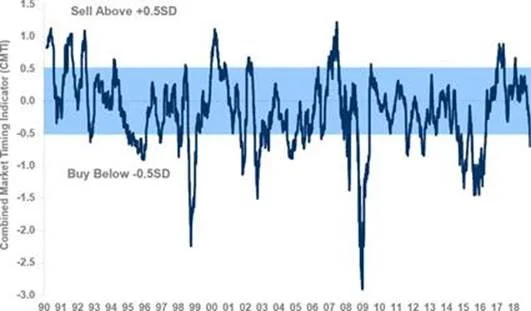

Europe has earned a “value trap” reputation & thus needs clear signs of growth bottoming before investors will participate but Morgan Stanley’s Market timing indicator (MTI) just flashed its first buy signal in several years (Chart 4) while HSBC’s client survey results noted a Eurozone 2.0 crisis as investors biggest 2019 worry. In addition, EU financial assets reacted well to recent poor economic data suggesting much is in the price. Latin America has the best growth profile of any region led by Brazil's cyclical recovery from a deep recession. Japan is cashed up, cheap and will benefit from M&A activity as well as China stabilization. China’s equity market offers earnings growth at very attractive valuations. Once the trade issue is resolved and growth stabilizes investor interest in China, Japan and Europe is likely to increase sharply.

Chart 4: Is it Finally time to buy Europe?

Source: Morgan Stanley

On the fixed income side, low yields and low inflation suggest yield plays will remain of interest and given the shellacking they took in Q4 opportunity would seem to beckon. The same can't be said for US Treasuries (UST) where recent auction results have been mixed; the UST supply-demand picture remains a concern & coupled with the flat yield curve leaves us focused on the belly of the curve. Bunds broke below the .25% bottom of its range but have since bounced back above (as did the 10 yr UST) suggesting that bonds are not confirming a recession.

PORTFOLIO STRATEGY AND ASSET ALLOCATION

GIven the volatility into year end we have reduced our risk profile by raising some cash and going neutral equity, underweight bonds and overweight alternatives & cash. An equity V shaped bottom vs retest remains an open question.

Within equities, we remain OW the non US equity markets. We reduced our financials position in both the US and Europe in order to lower our risk profile preferring risk positions in both China and Latin America which we believe have already bottomed.

In Fixed Income we trimmed our US HY position but remain constructive given favorable supply – demand characteristics, declining default rates, and the lack of repayment mountains. We believe the BBB monster fears whereby downgrades crash into US HY and capsize the space are overblown. We continue to hold positions in both EM USD debt as well as EM local currency. Our expectation for better EU growth leaves us with minimal exposure to non-US sovereign debt positions.

Within our Alternative sleeve we remain focused on broad commodity exposure with a tilt to energy via our MLP position. We have high conviction in OPEC, specifically Saudi, desire to maintain production cuts to ensure higher prices. We have added a gold position across our portfolios and expect gold to benefit from a Fed pause & subsequent dollar rollover.

We maintain solid cash positions as we await the economic & political signals noted above to add to our preferred risk positions.

GLOBAL MACRO SUITE PORTFOLIO CHANGES

Global Macro Multi Asset (GMMA)

Within equities, we reduced our US & European financials position.

On the fixed income side we reduced our US HY position given recent dislocations.

We added to cash to reduce risk and provide for future opportunity.

Global Macro Income (GMI)

As in the GMMA portfolio, we reduced our US HY position. In addition, we added an MBS position, eliminated a high dividend equity position and added to our gold position.

Global Macro Equity (GME)

As in the GMMA portfolio, we reduced our US & European financials position while also taking advantage of relative outperformance & reducing our US Min Vol position.

We entered into a gold position and added to our cash position.

We hope you find this monthly piece of value and look forward to engaging with you on a monthly and quarterly basis as we go thru 2019.

Jay Pelosky, CIO & Co-Founder

TPW Investment Management

DISCLOSURE:

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts are inherently limited and should not be relied upon as an indicator of future results. There is no guarantee that these investment strategies will work under all market conditions, and each advisor should evaluate their ability to invest client funds for the long-term, especially during periods of downturn in the market. Some products/services may not be offered at certain broker/dealer firms.

There can be no assurance that the purchase of the securities in this portfolio will be profitable, either individually or in the aggregate, or that such purchases will be more profitable than alternative investments. Investment in any TPWIM Portfolios, or any other investment or investment strategy involves risk, including the loss of principal; and there is no guarantee that investment in TPWIM’s Portfolios, or any other investment strategy will be profitable for a client’s or prospective client’s portfolio. Investments in TPWIM’s Portfolios, or any other investment or investment strategy, are not deposits of a bank, savings and loan or credit union; are not issued by, guaranteed by, or obligations of a bank, savings and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency.

The investment descriptions and other information contained in this are based on data calculated by TPW Investment Management, LLC (TPWIM) and other sources including Bloomberg. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. This report should be read in conjunction with TPWIM’s Form ADV Part 2A and Client Service Agreement, all of which should be requested and carefully reviewed prior to investing.