As The Tri Polar World Turns: 2021 Outlook - A Golden Age for Asset Allocation

MACRO THEMES

Well, November sure was memorable wasn’t it? It’s been that kind of year – filled with twists and turns and lots of unexpected outcomes. After several months of sideways market action, clarity around both Covid 19 vaccines & US elections ignited the Rotation Trade and sent global equity markets rocketing higher. Context is important however; even after this surge global equities (ACWI) are only up 5% over the past 3 months led by the non US markets (ACWX) up 9% with the S&P trailing badly, up only 2.5%. Best get used to US underperformance.

I was on BTV just before Thanksgiving and suggested that this clarity is worth much more than a few percent. I followed up with three points: that the November moves represented the first innings of a global equity bull market underpinned by a Global Economic Boom, the likes of which haven’t been seen in nearly 50 years and that the combination of the two suggest a coming “golden age” for global asset allocation after a decade of one way, long US asset markets, including equity, bonds & the dollar. Foreign investors, for example, now own roughly 35% of US equity, up from 28% in 2009.

Chart 1: Global Rotation Leads to Asset Allocation Golden Age

Our October Monthly highlighted “potential asset price swings an order of magnitude larger & faster than investors expect”. Check, now comes the inevitable what’s next? While our focus tends to be 12- 24 months forward rather than the coming days/weeks, an overbought equity condition coupled with near euphoric sentiment levels does suggest a pause and perhaps a pullback is in order. However, given positive seasonality coupled with our outlook, pullbacks are likely to be brief, limited and should be used to accumulate further exposure.

Risks? There is always something to go wrong – maybe it will be a US Govt shutdown on 12/12 as the politicians fail to stitch together a spending bill; maybe it’s a Q1 fiscal pothole across Europe and the US as politics impedes policy. Maybe it will be a glitch in the vaccine rollout, scheduled to begin in a few weeks. All of which is digestible; absent multiple failed vaccines one should not get off the good ship Rotation!

Given the amount of sell side verbiage one feels compelled to read at this time of year & in the interest of brevity let’s get right to it, using our trusted Global Risk Nexus (GRN) to guide us into the coming year.

HEALTH

Covid case growth appears to have peaked in the US, roughly 3 weeks behind Europe’s peak; cases remain almost nonexistent in much of Asia. Real time European mobility data suggest stabilization in activity levels. Several vaccine trials have concluded in November with positive outcomes and both Pfizer & Moderna are in front of the FDA seeking EUA. Vaccinations are thus likely to begin in a few weeks with possibly 20M Americans inoculated by YE. The same process is underway in Europe; the UK has just approved the Pfizer vaccine for immediate use beginning next week. Rarely has there been more welcome news, suggesting as it does that a pathway to some normalcy is within our grasp. How normal? Expect a return pretty much to pre Covid normal – a viewpoint supported by looking at life in China today (1st in Covid, 1st out, follow the leader).

Speed remains Covid’s signature: speed of spread, of policy response, of market reaction to said policy etc. More recently the speed of science has brought a vaccine to bear within a year when it normally takes close to a decade – that is truly Covid speed and reflects all of humanity’s ingenuity and smarts. As we noted last Spring when we updated the old market adage not to bet against the Fed – don’t bet against the Fed AND the global scientific community.

Now comes Covid speed’s next iteration: speed of delivery. And while there is much skepticism about how smoothly and quickly a vaccination program can roll out it’s our strong view that this too will go better than many expect. Our Tri Polar World (TPW) construct has long alerted us to the importance and power of global logistics and thus we believe the global community has never been better placed to execute on the vaccination mission. As we noted last month, Pfizer expects to have roughly 1.3B doses ready in 2021 and others will have millions if not billions more themselves.

Chart 2: Herd Immunity by Q3?

Vaccine capacity (millions of doses) for 2020 & 2021 as announced by drugmakers

Source: J.P. Morgan, COVID-19 compendium: Vaccine & therapeutic landscape by Kasimov et al from Oct 2020

We expect near herd immunity in the US by mid-year, with Asia along the same time lines and Europe by Q3. That doesn’t mean 100% immunized but rather roughly 70% of the population either immunized or already having had the disease and thus able to work, travel etc. The successful inoculation of 1st responders should encourage most to take the vaccination. Might airlines/Govts require vaccinations to travel across borders – maybe and why not – if a vaccination is free and readily available it will be much like getting a malaria shot before traveling to parts of Africa.

Like virtually all of life under Covid, the worst stage is the one we are in right now, going forward it is only likely to get better and better as the weather changes, more get vaccinated, tests and treatment breakthroughs continue and life slowly returns to some sense of normalcy. It is often darkest before the dawn and that is how we view the health segment of our universe today.

Better Covid control through science is imminent – that is the key investment point. Vaccines, once unknowable, are now weeks away. This is likely to upend many portfolios, stimulate asset allocation rotation and usher in a bear market for long duration debt.

ECONOMICS

2020 has encompassed both the worst & the best global growth quarters in modern economic history – what will 2021 bring? We expect a global synchronized economic boom, supported by record breaking global liquidity, the melding of fiscal and monetary policy, vaccines, and significant pent up global demand fueled by excess savings. Central Bank balance sheets are expected to expand by roughly $5T in 2021 & notwithstanding the recent surge in EU/US case counts, BofA reports 78% of the 41 countries it tracks have Manufacturing PMIs over 50 while 87% of its 38 global growth indicators are bullish/neutral, the highest in over a year and up from 76% in October.

The split screen nature of Covid life is visible in the twin realities of millions of Americans dependent on continued Govt support programs alongside all-time highs in household net worth supported by record highs in both house & stock prices. European savings rates remain very elevated, savings that can provide the fuel for a strong service sector rebound. China’s savings rates are also elevated & its dual circulation strategy prioritizes expanding domestic consumption. Overall, excess global savings are estimated at 7-10% of global GDP; there is plenty of fuel to supercharge the post Covid economic recovery.

Bottom line, we expect 2021’s Boom to be the strongest global growth year since 1973, almost 50 years ago, with growth over 6% (MS forecasts 6.4%). This growth surge is likely to extend into 2022 & beyond given that Central Banks are focused on letting inflation run a little hot. With the natural rate of interest in much of the DM close to zero, negative real rates will support further Govt fiscal support, cap ex and consumption. Vaccines should lead to the global service sector catching up to the robust global manufacturing sector with significant impact on US & EU employment levels.

Strong US and Chinese based consumption will prove supportive. This is an important point – both China and the US are clearly focusing on stimulating consumption: China’s Vice Premier Liu He recently wrote about the new 5 year plan, highlighting as a key objective to “increase the share of labor compensation as part of overall distribution” while Pres. Elect Biden’s economic team includes “4 of the best labor market economists in the country to head the UST and CEA”. From opposite ends of the ideological spectrum then both the US and Chinese leadership have concluded that they need to support the working classes.

There is near term concern over a US fiscal cliff tied to the expiry of the Govt spending bill on Dec 11th together with the YE cutoff for several Covid support programs. Much depends on politics and given that the US Senate makeup is unlikely to be known until early January this could set up for a weaker start to 2021 than necessary, particularly in contrast to Asia and Europe which remain ahead of the US in Covid terms. The possibility of a lame duck stimulus package exists – should it come to pass it will clearly qualify as a positive surprise.

Chart 3: US Fiscal Cliff Risk

Europe is struggling to get its Joint Recovery Fund (JRF) off the ground as well as finalizing its multi-year budget as Hungary and Poland dig in their heels. Expect a compromise to be reached – there is too much money involved at too important a time for there not to be one. At the individual country level, Germany leads the way as the race to replace Angela Merkel spurs politicians to seek support via the Federal checkbook – normal in most countries, unusual & timely in Germany. France & Italy among others have expanded their stimulus packages, in part to offset the negative impacts of Europe’s second Covid wave. The ECB is likely to act in coming weeks but the emphasis needs to be on the fiscal side. The risk is that countries lower their guard, expecting a vaccine inspired recovery to obviate the need for significant fiscal support.

Asia continues to move ahead, led by China’s resurgence, as indicated most recently by robust industrial profit growth, up 26% y/y in October. Asia’s recovery is broadening out with Taiwan, S Korea and Japan all recently reporting better than expected economic data. China’s 5 year plan, centered around its dual circulation strategy (DCS) & coupled with a growing desire to expand self-reliance & create its own tech stack, seems well thought out. Recent forecasts suggest 8% GDP growth next year.

China’s interest rate structure remains well above the other large economies with its 10 yr. Govt bond yielding over 3%, leading to sustained foreign capital inflows & a stronger currency. China’s FX strength encourages imports and consumption – thus supporting the DCS while providing an umbrella for the rest of Asia to compete & sending an inflationary impulse to the rest of the world. It may also lead to further global market access for Chinese capital as policy makers seek to balance inflows & outflows.

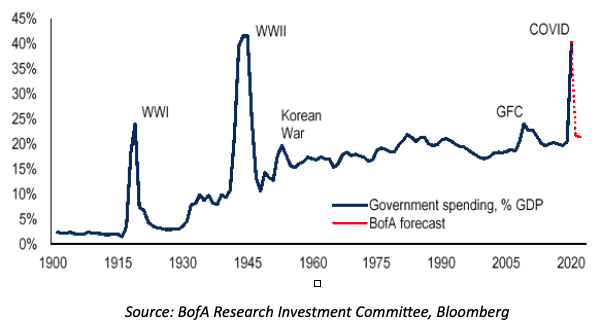

We continue to view the policy shifts from wealth concentration to wealth distribution, from fighting inflation to seeking inflation, from capital to labor and from monetary to fiscal as global in nature but regional in approach, especially in Asia and Europe. Boosting growth and stimulating consumption via fiscal stimulus at a time of record low interest rates remains the focus.

Our best guess for an economics surprise lies with inflation. At the moment few worry or even think about it as y/y numbers weaken across the globe from Europe to Japan and points in between. We expect 2021 to be very different with easy comps and the very real prospect for a supply – demand smash up mid-year as vaccinations take hold and consumer spending accelerates. The second Covid wave has rendered near term inflation concerns moot – the opposite is more likely to be the case in 2021. The medium term inflation picture will be driven by how long it takes to close the considerable global output gap.

Chart 4: Inflation Ahead?

Source: Commerce Department, Morgan Stanley, Goldman Sachs

POLITICS

The US election is over but for the Electoral College voting on Dec 14th and at least one man, President Trump, is holding out for that very thing. His legal team’s clown show has run off the rails and is thankfully coming to an end while he has relented on the transition. For his part, Pres. Elect Biden and his rapidly expanding team is preparing to come to grips with the pandemic, its vaccines and an economy that shows alternating signs of running hot and cold.

Chart 5: US: A Post Truth Nation?

On the foreign policy side, the Biden team seems filled with experienced folks whom Biden knows well and has worked with in the past. Given Biden’s years as VP and on the Senate Foreign Relations Comm he is likely the most knowledgeable foreign policy President since George H.W. Bush. While there will be calibration internationally we don’t expect dramatic or immediate change, even with China or in the Middle East.

We expect more action domestically and the recently announced economics team supports that idea. The focus will be on expanding and supporting the work force in an effort to draw the sting from the populist tail. Janet Yellen is ideally suited to lead this effort given her labor economics background and activist history in her prior roles.

The potential for a Biden presidency to be transformative is quite significant, reflecting the stagnation of the past decade or so and the impetus of Covid 19 in pushing so many policy challenges forward: health care, employment, housing, inequality, racial injustice, climate etc. etc. Biden is a moderate but he is likely to fight hard not to be seen as a caretaker President. This coupled with his understanding and knowledge of how Washington & the Senate work could create the dynamic for a much more robust & progressive US economic policy response in the coming years than many imagine, even in a divided Govt.

Speaking of which, the US Senate composition remains up in the air and won’t be known until early January (Georgia runoffs on Jan 5th). At this point both races seem to be toss ups suggesting that the legislative process will require all of Biden’s skill. While there will be battles it is likely and certainly hoped that Washington will provide much less daily angst for investors than it has over the Trump years. Partisan gridlock is a worry and may lead to valuation discounts in the US after a decade of premium valuation built into virtually all US assets – certainly from a TPW perspective, the Americas, led by the US, are lagging while Europe and Asia accelerate their integration.

Europe’s bruising political battle between Hungary and Poland and the rest over the rule of law and the disbursement of JRF/budget monies should be settled shortly. Given the EU’s need for unanimity, the two are on fairly strong ground but they are also upsetting all their neighbors whose populaces are hurting and who would welcome the support that is presently tied up. We expect some sort of a face saving compromise at the upcoming EU Leaders summit given that the budget expires at YE.

Chart 6: EU Integration Ahead

There is also Brexit to consider; the odds favor some sort of a deal by Dec 31st. The UK has much more to lose than the EU. We struggle to think PM Johnson really wants to start 2021 off watching traffic pile ups that stretch for miles; queues that long might be too much even for the Brits.

Casting our eyes further afield, 2021’s big election may well be the race to replace Germany’s Angela Merkel who has been in power for roughly 15 years. Her departure suggests a gap in pan European leadership which will be worth watching. Japan goes to the polls as well; PM Suga may well seek his own term there.

POLICY

Health policy in the form of vaccine approval and distribution remains critical, followed by the melding of fiscal & monetary policy conducted by Janet Yellen in the US and Christine Lagarde in Europe. Fiscal policy is the new game in town. Both know better than most how powerful and important the twin levers of policy can be – they are very well placed to ensure that such a melding does in fact happen. The Fed and ECB’s embrace of asymmetric inflation targeting (AIT) implies those expecting the Fed to cap the back up in long rates associated with a recovering economy will be proven wrong. Fiscal policy requires political collaboration, something in quite short supply in the US though Joe Biden believes there are a handful of Republican Senators he can work with. Our 2021 boom outlook requires both fiscal and monetary policy together with a vaccine to take effect.

A fiscal package is likely as part of the Biden’s team first 100 days – the question is the sizing & politics will likely determine the answer. From both an economic and political perspective it looks like the Biden team will seek to go big on fiscal stimulus arguing that history suggests such (many were involved in the Obama GFC workout) as does the negative real rate structure. Debt/GDP ratios are said to be outmoded and some outside the team (Furman, Summers) advocate for a revolution in thinking about how the Govt should tax, borrow and spend in such a macroeconomic setting. Republicans will likely have much to say on this of course. Biden is likely to govern with an economic team devoted to full employment and letting the economy run hot; both Moody’s and GS suggest Biden’s economic plan will boost GDP by close to 4% more than the Trump plan.

Europe needs to find a way past the spat noted above with Hungary & Poland in order to unlock its JRF and multiyear budget. The Green Deal is off to a good start with multiple joint issues of green bonds. Joint issuance followed by joint taxation, the creation of an EU safe asset & yield curve could underpin the Euro as a reserve currency & change how investors view Europe. We have written about the potential for Europe to win the 2020s but execution will be key.

The multi-year nature of Europe’s main programs suggest (pending ratification) that Europe’s medium-term policy path is set. Further European integration is possible – perhaps on the banking union side. Germany has recently signaled it can see a path to common deposit insurance which has been a no no for years. Should this come to pass then one can expect significant (and much needed) cross border European bank M&A.

Covid 19, climate change and the US - China rivalry have served to accelerate the Tri Polar World (TPW). The shift in trade from global to regional and the need for smaller countries to move closer to the central economy in each region further reinforces regional integration. Manifesting this trend in real time is Asia’s newly signed Regional Comprehensive Economic Partnership (RCEP) which will encompass roughly 30% of the world’s population & GDP as it ties much of Asia (minus India) together. Asian intra-regional trade is already surging with ASEAN becoming China’s second largest trading partner even before RCEP is ratified.

Chart 7: Asian Integration Leads the Tri Polar World

Japan is a big RCEP winner as it doesn’t have FTAs with either China or S Korea. Perhaps most significantly, RCEP’s rules of origin support regional supply chains (RSC) becoming more efficient by allowing companies to split their regional supply chains across multiple countries within RCEP. This creates greater incentives for companies to maintain and expand their Asian RSC which in turn will likely boost spending, investment & integration. Trade policy is clearly a key driver to regional integration and Asia is leading the way. US gridlock in the coming years risks the Americas falling further and further behind Asia & Europe. Biden knows Latin America well; an active Biden Admin could be quite bullish for integration in the Americas.

Climate change policy is another area that has real potential to boost activity and catalyze change in the coming years. Europe’s Green Deal, China’s UN announcement that it will be carbon neutral by 2030 and carbon negative by 2060 continue to resonate. Japan & S Korea have also pledged to go carbon neutral. Perhaps of most interest are the growing numbers of global companies pushing their host countries to provide more green energy as their shareholders push companies to green their supply chains.

Recent studies suggest China has outspent the US in renewable investments by roughly $300B over the past 5 years (2015-19). Thus, it’s no surprise that a Biden Presidency will look to rejoin the Paris Accord ASAP – the US runs the risk of falling way behind in the EV race for example. Already China’s Big 4 EV makers have a market cap close to 50% of Tesla’s while China has roughly 80% + of the world’s charging stations. Biden’s decision to elevate climate change to the National Security level with John Kerry at the helm suggests an infrastructure – climate change stimulus package could well be a 2021 event.

MARKETS

We expect a golden opportunity for asset allocation to add alpha in the coming years. After a decade long run of US financial asset dominance it’s a whole new ball game, from assets to regions, countries to sectors, factors to styles. Some have speculated that as a result of zero rates and limited FX moves that macro investing is dead. We take the other side and argue that global macro – the investing across assets based on insight gleaned from economics, politics and policy - is about to enjoy a golden age of thematic investing.

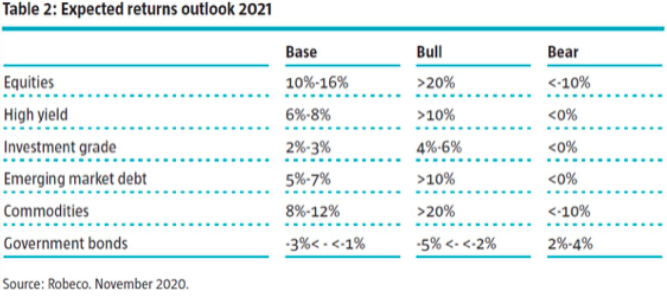

We foresee continued risk asset upside through the next several years as the global equity bull market expands. Cross asset wise, Global equity and Commodities would seem to have the most upside given our outlook. We are dropping the term Trade from the Global Rotation Trade we have spoken of for the past several months – it’s now just the Global Rotation as the equity leadership baton passes from Growth to Value, from Tech to Financials, from Defensives to Cyclicals, from Large Caps to Small & from the US to the non US markets. With Tech = 30-40% of the US equity market, the two will go down as well as up together, suggesting an equal weighted approach to US equity indices. See Chart 8.

Chart 8: Some Context for 2021 Returns

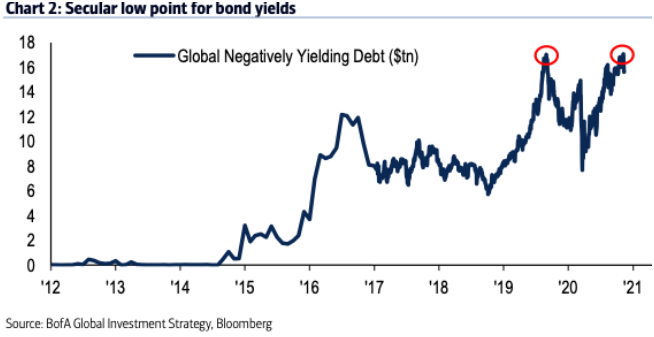

Global equity leadership has shifted to Asia in line with our 1st in Covid, 1st out thesis; a thesis we followed in developing our Covid investing formula last Spring: control the virus > reopen the economy > broaden the stock market advance > outperform. We expect Europe to join Asia in the global leaderboard next year. Investors should prepare for not only an economic boom in the coming years but an earnings & buyback boom as well after both collapsed in 2020. We expect this global growth boom to lead to a bear market in DM long duration Sov debt, to continued weakness in the USD and to a new bull market in Commodities as suggested by Dr. Copper.

Amidst all the talk of the best November ever, etc. etc. it's important to note that on a longer term basis many markets have been quiescent. ACWX, for example, remains 3% below its 2018 high. The SPY is only up 2% over the past three months, a period which encompassed successful Covid vaccine trials, a smooth and orderly US election process and growing business and health adaptation to continued Covid case surges. The rotation is underway; US Tech peaked vs Value back in early September. As we have noted for several months: vaccines, re openings and rising rates = kryptonite for Tech. Regulatory concerns coupled with very tough earnings comps next year will further challenge the tech sector as much of the WFH vibe proves short lived and pulled forward rather than developing consistent new demand.

Given 2021 expected earnings growth next year between 20-30% across much of global equities we expect significant further equity upside. Valuation concerns outside Big Tech are overdone. The broadening out of the market advance both in stock and country terms supports this optimism. Notwithstanding the big jumps in Cyclical sectors last month there remains much ground to make up between Tech and Financials, Energy, Small Caps etc. The same holds true for the wide performance gap between US equity and the rest. For example, over the past two years the SPY is up roughly 38% vs ACWX up 18%; over the past 5 years the US is up 75% or so vs 25% for ACWX. See Chart 9.

Catalysts exist for the continuation of the Global Rotation, namely in terms of interest rates. The back up in rates we expect should do wonders for financial stocks globally and most especially in the US and Europe. Rebounding global growth should support rising oil prices and thus energy stocks, still down roughly 50% (US) from their 52 week highs. The return of dividends and buybacks in European bank stocks provide further upside support as does valuation, a better economy, reduced provisioning and potential M&A activity.

The essence of the Growth/Value trade is Tech/Financials and we view rising rates as the fulcrum for the Rotation, spurring on Cyclicals/Value while simultaneously capping Tech. We expect vaccines to stimulate economic activity & lead to rising rates, especially at the long end which now has to bear all the inflation and supply related risk given a pegged short end.

Chart 9: Value Stocks & Global Commodities Lead the Way

Importantly we expect US equity to lag on a relative basis but not crash – the same with tech stocks; we expect Value to rise up to Growth, not Growth crash down to Value. This environment is the best for ROW outperformance. Both Tech equity and long duration debt will roll over slowly – given the extent of their respective bull markets this makes sense. It also further supports the thesis of a multi-year asset allocation shift.

We remain significantly overweight equity in a multi asset portfolio, overweight non US DM vs US and EM. EM equity has a lot of adherents; BofA’s well respected FMS’s #1 trade for 2021 is long EM equity, long US equity was #2. EAFE, i.e. Europe and Japan, didn’t make the top 5. Non-US DM provides inexpensive and under owned Cyclical/Value exposure. That spells opportunity. Within EM we have added a Latin American equity position to our existing China and East Asia tech chains. We remain overweight Cyclical and Value together with small caps in terms of styles/factors. Financials (both US and EU) are especially favored (BTV 'Screaming Buy').

Fixed Income is at an inflection point; one we expect to herald quite limited returns & the beginning of a long duration Sov bond bear market. Thus, we expect the Bloomberg consensus for 2021YE 10 yr. UST rates at 1.2% to be way off the mark; our own pencil suggests 10 yr. UST rates between 1.75-2.0% a year from now. We expect a similar move in German BUNDs with rates closer to zero in 12 months. Fixed income investors will be challenged after a near 40 year bull market. One can look to how China’s 10 year Govt bond performed during 2020 for clues to 2021’s UST market.

Chart 10: Long Bond Bear Market

A taper tantrum in long dated Sovereigns seems quite feasible, especially given all the 2021 supply that is coming from state, sovereign & quasi sovereign issuers. Banks have been huge buyers of UST; should the economy recover and banks open the lending window who will replace them as giant UST buyers? The charts (TLT, AGG) look like they are rolling over.

We disagree with those who argue the Fed will not allow long rates to back up, especially in the first blush of vaccine related recovery given that such yield curve steepening will support the banks who in turn will support the recovery with more credit. Watch the UER; it probably needs to break below 5% (now 6.9%) before the Fed starts to make noise; given that service sector UER is 16% this is the critical segment of the economy to watch.

Thus we remain quite underweight Sovereigns with the exception of EM $ debt, prefer Credit and within credit HY given a modest default cycle, continue to hold Preferreds and have added some commercial real estate exposure. The office is dead thesis is about as valid as NYC is dead – in other words – dead wrong. Covid has extended the credit cycle – IG is at risk to rate back up given the duration extension of the latest refinancing wave. The shift in inflation regimes is likely to have real ramifications for pension funds, risk parity strategies and 60-40 portfolios. 2020 has been quite good for 60-40 portfolios; our advice is to prepare for a different environment in the years ahead.

Within the FX space we continue to expect a gradually weaker USD as global growth recovers and US assets are used as sources of cash for investors to reposition around the globe. There is limited space for dollar weakness vs other major currencies, especially the Euro and Yen but more room perhaps against the commodity currencies and the Chinese RMB. A gradually strengthening RMB has major implications for the rest of Asia, for a Europe selling into Asia and for the US which has spent the last several years arguing against an (expanding) trade deficit with China.

China needs foreign capital to offset the end of its current account surplus regime. Importing foreign capital to help drive self-reliance and domestic demand makes sense. While US assets are sources of cash, Chinese assets are very under owned with some reports suggesting that global investors have roughly 5% weighting vs an estimated 15-20% equity/bond allocation based on benchmarks. A Biden Administration that moves away from the Trump team’s financial asset focus could spur significant allocations into China. The recent spurt of Chinese bond defaults, seen in this light, are a clean-up operation designed to prepare the way for more robust foreign ownership.

From a Tri Polar World POV we note the beginnings of regional currency blocs: RMB led in Asia, the Euro in Europe and the USD in the Americas. Note that the Euro overtook the USD as most widely used currency in the global payments system in October for the 1st time since 2013.

Commodities, especially energy and industrial metals, could outperform equities in 2021. Dr. Copper has broken out of a seven year range while a dearth of cap ex in energy and metals over the past few years could set up a supply – demand imbalance reinforced by surging Chinese growth. Negative real rates across the advanced economies suggest precious metals should also remain favored though the offset of higher nominal rates could be a limiting factor. Gold has reflected this conundrum over the past month or so. We have shifted our metal exposure to silver to benefit from its industrial – clean energy demand while remaining long Gold miners. November offered significant upside in both clean and old energy; an anomaly that we expect to continue in 2021. We are long both. Be careful with broad ESG instruments – many have big Tech weightings and consequently peaked vs Value in September.

Disclosure:

Past performance is no guarantee of future results. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role. The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts are inherently limited and should not be relied upon as an indicator of future results. There is no guarantee that these investment strategies will work under all market conditions, and each advisor should evaluate their ability to invest client funds for the long-term, especially during periods of downturn in the market. Some products/services may not be offered at certain broker/dealer firms.

There can be no assurance that the purchase of the securities in this portfolio will be profitable, either individually or in the aggregate, or that such purchases will be more profitable than alternative investments. Investment in any TPWIM Portfolios, or any other investment or investment strategy involves risk, including the loss of principal; and there is no guarantee that investment in TPWIM’s Portfolios, or any other investment strategy will be profitable for a client’s or prospective client’s portfolio. Investments in TPWIM’s Portfolios, or any other investment or investment strategy, are not deposits of a bank, savings and loan or credit union; are not issued by, guaranteed by, or obligations of a bank, savings and loan, or credit union; and are not insured or guaranteed by the FDIC, SIPC, NCUSIF or any other agency.

The investment descriptions and other information contained in this are based on data calculated by TPW Investment Management, LLC (TPWIM) and other sources including Bloomberg. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. This report should be read in conjunction with TPWIM’s Form ADV Part 2A and Client Service Agreement, all of which should be requested and carefully reviewed prior to investing.